Biturai Trading Wiki

The ultimate crypto encyclopedia. Verified by experts.

Yield Curve in Crypto: A Deep Dive for Biturai Traders

The yield curve is a graphical representation of the relationship between interest rates and the time to maturity of debt securities. In the crypto world, it's used to understand market sentiment, liquidity, and potential price trends.

Risk Free Rate in Cryptocurrency

The risk-free rate is the theoretical return an investor can expect from an investment with zero risk. In crypto, it's often approximated by yields from low-risk instruments or market-implied rates.

Risk Premium: A Comprehensive Guide

Risk premium is the additional return investors expect for taking on more risk. Understanding risk premium is crucial for making informed investment decisions in the crypto market and beyond.

Variance in Crypto: Understanding and Trading Volatility

Variance is a statistical measurement of how spread out a set of data points are from their average value. In crypto, it helps you understand price volatility and manage risk.

CFTC Commodity Futures Trading Commission

The Commodity Futures Trading Commission (CFTC) is a U.S. government agency that regulates the derivatives markets, including futures and options. The CFTC's main goal is to ensure these markets are fair, transparent, and operate with integrity, protecting traders and investors.

Hidden Order Explained in Crypto Trading

Hidden orders are a strategic tool used in crypto trading to execute large trades without immediately impacting market prices. They achieve this by concealing the size of the order, allowing traders to buy or sell significant amounts discreetly.

Ask Price Explained: A Comprehensive Guide

The "ask" price in cryptocurrency trading is the price at which a seller is willing to sell a particular crypto asset. Understanding the ask price, its relationship to the bid price, and the resulting spread is crucial for successful trading.

Premium Zone: Understanding Cryptocurrency Price Dynamics

The Premium Zone in cryptocurrency trading represents a price level where assets are considered to be trading at a premium, often indicating potential for distribution. Understanding the Premium Zone is crucial for traders seeking to identify potential sell-off opportunities and manage risk effectively.

External Liquidity: The Lifeblood of Crypto Markets

External liquidity is the availability of assets to be bought or sold quickly without drastically changing their price. Understanding external liquidity is critical for successful trading and investment in the cryptocurrency space.

Stop Hunt: Understanding Market Manipulation in Crypto

Stop hunting is a market manipulation technique where large traders trigger stop-loss orders to profit from price drops. This article explores how stop hunts work, why they happen, and how traders can protect themselves.

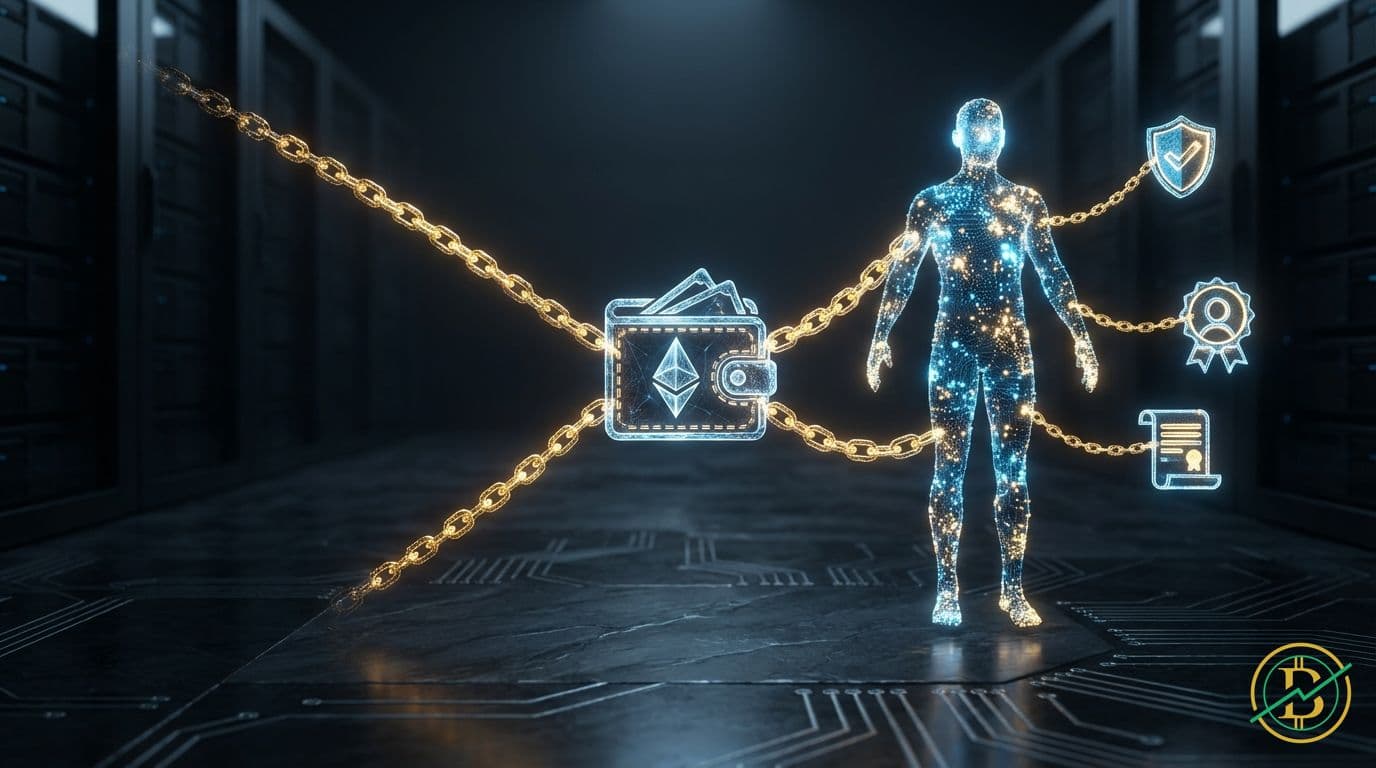

Soulbound Tokens: Your Identity in Web3

Soulbound Tokens (SBTs) are non-transferable digital assets designed to represent your identity, achievements, and affiliations in the Web3 world. Think of them as verifiable digital resumes or badges of honor.

Virtual Land NFTs: A Comprehensive Guide

Virtual Land NFTs represent ownership of digital real estate within metaverse platforms. These NFTs allow users to buy, sell, and develop digital parcels, offering unique opportunities for speculation and utility.

Algorithmic Stablecoins: A Deep Dive

Algorithmic stablecoins are cryptocurrencies designed to maintain a stable value, usually pegged to a fiat currency like the US dollar, without relying on traditional collateral. They achieve this stability through complex algorithms that automatically adjust the token supply in response to market demand.

EigenLayer: The Comprehensive Guide to Ethereum Restaking

EigenLayer is a protocol built on Ethereum that allows users to restake their staked ETH to secure other applications. This innovative system expands the utility of staked ETH and enhances the overall security of the Ethereum ecosystem.

Constant Product Formula

The Constant Product Formula is the core mathematical principle behind many decentralized exchanges (DEXs). It ensures liquidity providers can facilitate trades while maintaining a constant product of token reserves.

Liquidity Provider (LP): The Engine of Decentralized Finance

Liquidity Providers (LPs) are the unsung heroes of Decentralized Finance (DeFi), supplying the assets that allow for trading on decentralized exchanges (DEXs). They earn rewards for providing this crucial service, but it's important to understand the risks involved.

Silk Road Shutdown: A Deep Dive into Cryptocurrency's Darkest Chapter

The Silk Road, a pioneering darknet marketplace, was shut down by the FBI in 2013, marking a pivotal moment in cryptocurrency history. This event exposed the vulnerabilities of early Bitcoin transactions and highlighted the challenges of regulating decentralized technologies.

M1 Money Supply: The Foundation of Liquidity

M1 money supply represents the most liquid forms of money in an economy, including physical currency and readily accessible deposits. Understanding M1 is crucial for grasping how central banks manage the economy and how traders can anticipate market movements.

Money Supply in Cryptocurrency and Traditional Finance

The money supply refers to the total amount of money circulating in an economy. Understanding how money supply works is crucial for comprehending market dynamics and making informed investment decisions, especially in the volatile world of cryptocurrencies.

Quantitative Tightening Explained

Quantitative Tightening (QT) is a monetary policy tool used by central banks to reduce the amount of money circulating in an economy. This process aims to combat inflation and stabilize financial markets by shrinking the central bank's balance sheet.