Biturai Trading Wiki

The ultimate crypto encyclopedia. Verified by experts.

Swing Low: A Comprehensive Guide for Crypto Traders

A swing low is a crucial concept in technical analysis, marking a temporary bottom in an asset's price before an upward reversal. Understanding swing lows is essential for identifying potential entry points, managing risk, and anticipating market movements in the volatile world of cryptocurrencies.

Crypto Transaction: A Comprehensive Guide

A crypto transaction is a digital record of value transfer on a blockchain. It involves moving data across a network, validated and confirmed by nodes. Understanding transactions is fundamental for anyone participating in the crypto ecosystem.

Poly Network Hack: A Deep Dive

The Poly Network hack, a significant event in cryptocurrency history, involved the theft of over $600 million. This article breaks down the mechanics of the hack, its implications, and the lessons learned.

LFG: Understanding Crypto Enthusiasm

LFG, short for "Let's Fucking Go," is a common expression of excitement and bullish sentiment within the cryptocurrency community. It signifies strong support for a project or the market's overall performance, often used during periods of price increases or positive news.

DYOR: Mastering Cryptocurrency Due Diligence

DYOR, or "Do Your Own Research", is a fundamental practice in the cryptocurrency world. It means taking the initiative to independently investigate any crypto project before investing, protecting you from scams and ensuring informed decisions.

REKT: Understanding Devastating Losses in Cryptocurrency Trading

In the world of cryptocurrency, "REKT" is slang for experiencing significant financial losses, often due to unfavorable trades or market volatility. This article provides a comprehensive overview of what it means to get REKT, its origins, and strategies to mitigate such risks.

Pumping in Cryptocurrency

Pumping in the cryptocurrency market refers to a rapid and often artificial increase in the price of a digital asset. This can happen organically due to market forces or be the result of manipulative schemes, potentially leading to significant financial risks.

Wen Moon: Understanding Cryptocurrency Price Increases

Wen Moon is a slang term within the cryptocurrency community, expressing the hope that a specific digital asset will experience a substantial price increase. It reflects the bullish sentiment and optimism of investors looking for significant returns.

Wen Lambo: The Crypto Dream of Luxury

“Wen Lambo?” is a popular phrase in the crypto community, essentially asking when an investor will become wealthy enough to buy a Lamborghini. It represents the aspirational dream of financial freedom and the potential for life-changing gains through cryptocurrency investments.

Paper Hands: Understanding Fear and Selling in Cryptocurrency

Paper hands is a colloquial term for investors who sell their crypto holdings quickly during market downturns, often driven by fear. This behavior can lead to missed opportunities and contribute to market volatility. Learn how to identify and avoid paper-handed tendencies for more successful long-term crypto investing.

Diamond Hands: A Biturai Guide to Crypto Perseverance

Diamond Hands refers to the unwavering commitment of an investor to hold onto their cryptocurrency investments, regardless of market volatility. This strategy prioritizes long-term belief in the asset over short-term price fluctuations, contrasting with the 'Paper Hands' approach of selling quickly during downturns.

Market Value in Cryptocurrency

Market value, in the cryptocurrency world, represents the total worth of a digital asset based on its current price and circulating supply. Understanding market value is essential for assessing investment opportunities and gauging the overall health of the crypto market.

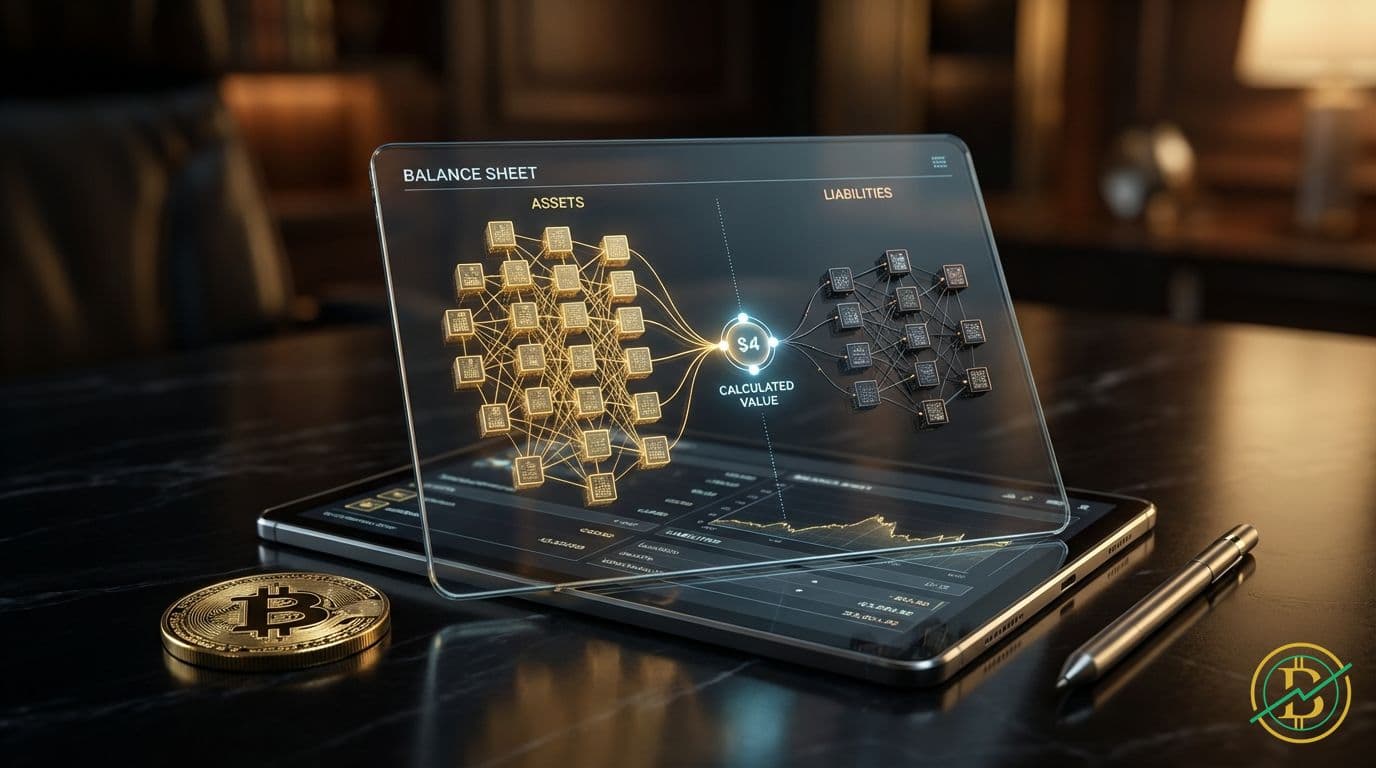

Book Value in Crypto: A Comprehensive Guide

Book value represents the net asset value of a company or digital asset, reflecting its worth based on its balance sheet. Understanding book value is crucial for assessing the fundamental value of crypto holdings and making informed investment decisions, particularly when compared to fair market value.

Discounted Cash Flow (DCF) in Crypto: A Comprehensive Guide

Discounted Cash Flow (DCF) is a valuation method used to estimate the value of an investment based on its expected future cash flows. This guide explains DCF, its mechanics, and its relevance in the crypto space, equipping you with the knowledge to make informed investment decisions.

Exchange Traded Funds (ETFs) in Crypto: A Comprehensive Guide

An **Exchange Traded Fund (ETF)** is a type of investment fund that tracks an index, a commodity, bonds, or a basket of assets. Crypto ETFs offer a way to invest in cryptocurrencies without directly owning the underlying assets, providing exposure to price movements through traditional exchanges.

Crypto Index Funds Explained

A crypto index fund is a financial product designed to track the performance of a specific basket of cryptocurrencies. It offers investors a way to gain exposure to a diversified portfolio of digital assets without having to individually buy and manage each one.

Active Investing in Crypto: A Biturai Guide

Active investing in cryptocurrency involves making frequent trades to capitalize on short-term price fluctuations. This approach contrasts with passive investing, which focuses on long-term holding. Understanding active investing is crucial for anyone looking to navigate the volatile crypto market.

Passive Investing in Crypto: A Biturai Guide

Passive investing in crypto is a long-term strategy that focuses on gradual wealth accumulation. This approach involves selecting investments that mirror market indexes or specific sectors, and holding them for extended periods to benefit from overall market growth.

Growth Investing: A Biturai Deep Dive

Growth investing is a strategy focused on identifying companies poised for rapid expansion. This approach seeks to capitalize on businesses that are expected to outperform the market average, leading to potentially significant returns.

Dollar Cost Averaging in Cryptocurrency: A Comprehensive Guide

Dollar Cost Averaging (DCA) is a straightforward investment strategy where you invest a fixed amount of money in cryptocurrency at regular intervals. The goal is to reduce the impact of market volatility and potentially achieve a lower average cost per unit over time.