Biturai Trading Wiki

The ultimate crypto encyclopedia. Verified by experts.

Piercing Pattern Explained: A Comprehensive Guide

The Piercing Pattern is a bullish reversal candlestick formation signaling a potential shift from a downtrend to an uptrend. Understanding this pattern, its mechanics, and associated risks is crucial for making informed trading decisions.

Engulfing Pattern Explained: A Comprehensive Guide

The **Engulfing Pattern** is a powerful candlestick formation signaling potential market reversals. This pattern, easily recognizable, suggests a shift in momentum, offering traders valuable insights into price action and potential trading opportunities.

Gravestone Doji: A Comprehensive Guide to Bearish Reversal

The Gravestone Doji is a bearish candlestick pattern that signals a potential reversal of an uptrend. It forms when the opening, closing, and low prices of an asset are nearly the same, resembling an inverted 'T'.

Dragonfly Doji: A Comprehensive Guide to Bullish Reversals

The Dragonfly Doji is a powerful candlestick pattern signaling a potential bullish reversal. It appears when sellers initially drive prices down, but buyers then step in to push the price back up to, or very close to, the opening price.

Inverted Hammer Candlestick Pattern: A Biturai Guide

The Inverted Hammer is a bullish reversal candlestick pattern, appearing at the end of a downtrend and suggesting a potential price increase. It’s a single-candle formation with a small body and a long upper wick, signaling that buyers may be starting to take control.

Inverse Head and Shoulders: A Biturai Guide to Bullish Reversals

The Inverse Head and Shoulders pattern is a powerful technical analysis formation that signals a potential bullish reversal after a downtrend. Understanding this pattern is crucial for identifying profitable trading opportunities in the crypto market.

Double Top: A Comprehensive Guide to Bearish Reversal Patterns

A Double Top is a bearish technical analysis pattern that signals a potential reversal from an uptrend to a downtrend. It forms when an asset's price reaches a high point twice, with a moderate decline in between, suggesting a possible shift in market sentiment.

Hammer Candlestick Pattern: A Guide for Crypto Traders

The Hammer candlestick pattern is a bullish reversal signal that appears at the bottom of a downtrend. It signals that buyers are starting to take control, potentially leading to a price increase. Understanding the Hammer can significantly improve your ability to identify potential entry points and manage risk in crypto trading.

Evening Star: A Comprehensive Guide to Bearish Reversal

The Evening Star is a bearish candlestick pattern that indicates a potential trend reversal from bullish to bearish. This guide will provide a deep dive into understanding and trading this powerful pattern.

Diamond Bottom: A Comprehensive Guide

The Diamond Bottom is a bullish reversal chart pattern, typically signaling the end of a downtrend. It's formed by two symmetrical triangles and indicates that buyers are starting to gain control.

Diamond Top Chart Pattern: A Comprehensive Guide

The Diamond Top is a bearish reversal pattern, signaling a potential trend change from bullish to bearish. This guide provides a detailed understanding of the Diamond Top, its mechanics, and how to use it in crypto trading.

Bump and Run Reversal: Decoding the Market's U-Turn

The Bump and Run Reversal (BARR) pattern signals a potential end to an uptrend, providing traders with an opportunity to anticipate a price decline. This pattern, characterized by a rapid 'bump' followed by a sustained 'run', offers valuable insights into market sentiment and potential profit-taking strategies.

Rounding Bottom: A Comprehensive Guide to Bullish Reversals in Crypto

The Rounding Bottom is a bullish chart pattern indicating a potential trend reversal from bearish to bullish. It resembles a 'U' shape and signals a gradual shift in market sentiment, offering traders opportunities to capitalize on the emerging uptrend.

Triple Top Chart Pattern: A Comprehensive Guide

The Triple Top is a bearish chart pattern signaling a potential reversal of an uptrend. It forms when an asset price attempts to break a resistance level three times and fails, leading to a decline.

Triple Bottom: A Comprehensive Guide

A Triple Bottom is a bullish reversal pattern, signaling a potential shift from a downtrend to an uptrend. This pattern forms when an asset's price tests a support level three times without breaking below it, creating three distinct lows.

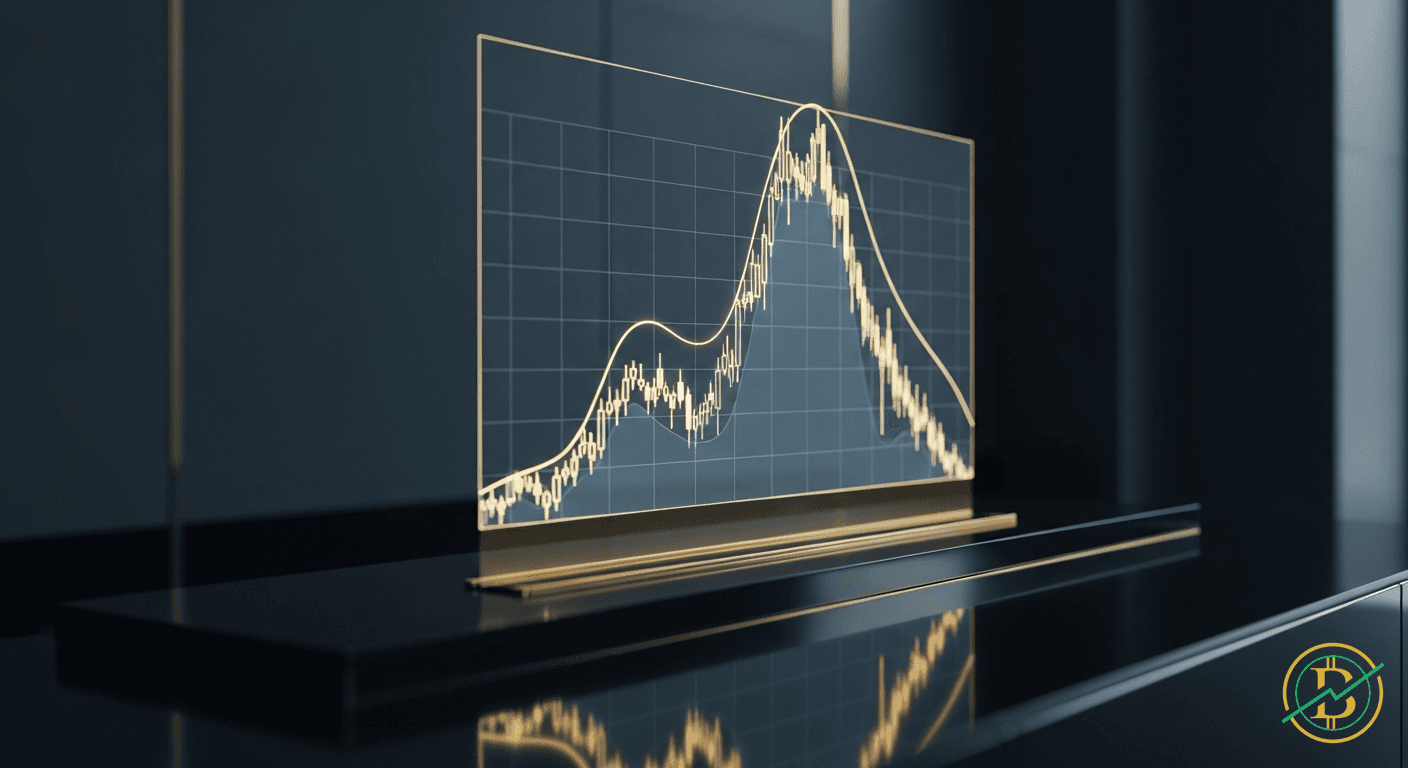

Rounding Top Chart Pattern: A Comprehensive Guide

The Rounding Top is a bearish reversal pattern that signals a potential end to an uptrend. It's a key tool for crypto traders to identify opportunities to short or exit long positions.

Double Bottom Pattern Explained

The Double Bottom pattern is a bullish technical analysis formation indicating a potential reversal from a downtrend. It signals that the price has found strong support at a specific level, making it a key indicator for traders.

Dynamic Support and Resistance in Cryptocurrency

Dynamic support and resistance levels are constantly adjusting price boundaries. These levels shift with market movement to create flexible trading zones, reflecting current price action.

Woodie Pivot Points: A Comprehensive Guide for Crypto Traders

Woodie Pivot Points are a technical analysis tool used to identify potential support and resistance levels in the market. They are calculated using the previous day's open, high, low, and close prices, providing traders with valuable insights to make informed trading decisions.

Murrey Math Lines: The Ultimate Crypto Trading Guide

Murrey Math Lines are a technical analysis tool that helps traders identify potential support and resistance levels. By dividing price ranges into eighths, it provides a framework for anticipating price movements.