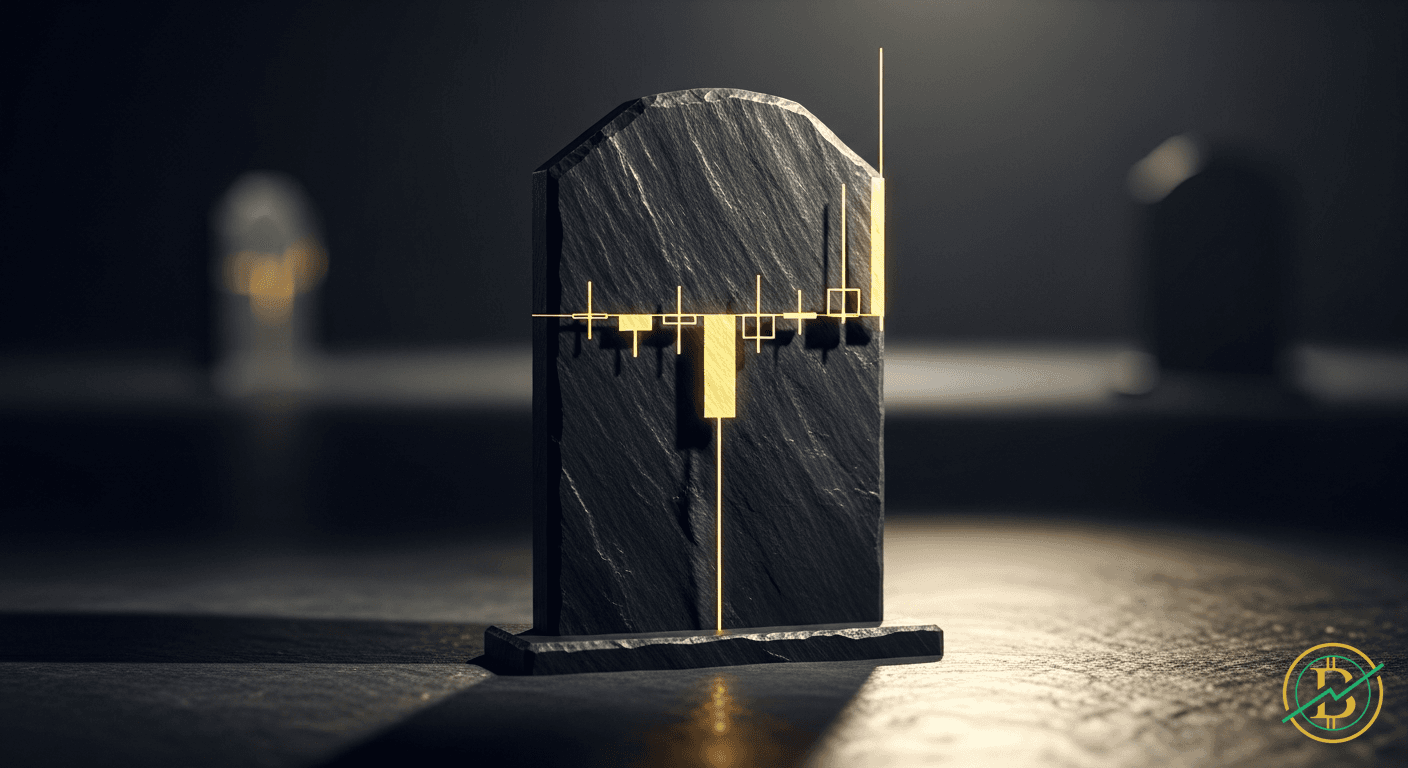

Gravestone Doji: A Comprehensive Guide to Bearish Reversal

The Gravestone Doji is a bearish candlestick pattern that signals a potential reversal of an uptrend. It forms when the opening, closing, and low prices of an asset are nearly the same, resembling an inverted 'T'.

Gravestone Doji: A Comprehensive Guide to Bearish Reversal

INTRO: In the world of trading, understanding how to read price charts is crucial. Imagine a chart as a storybook of market activity, where each candlestick tells a tale about the battle between buyers and sellers. The Gravestone Doji is one such story, a visual clue that often warns of a potential price decline. It’s a simple pattern to recognize, but understanding its implications can significantly improve your trading decisions.

Key Takeaway: The Gravestone Doji is a bearish reversal candlestick pattern, indicating that the buyers attempted to push the price higher but ultimately failed, leading to a potential downtrend.

Definition

The Gravestone Doji is a bearish candlestick pattern that forms when the open, low, and closing prices of a security are at or very near the same level, with a long upper shadow.

This pattern looks like an upside-down 'T'. The long upper shadow represents the high of the trading period, while the body (the open, close, and low) is a small horizontal line at the bottom. This formation signals a strong rejection of higher prices during a trading session. Essentially, the buyers initially gained control, pushing the price up, but the sellers eventually overpowered them, driving the price back down to the opening level.

Mechanics

The formation of a Gravestone Doji involves a specific sequence of price movements within a given trading period. Here's a step-by-step breakdown:

- Opening Price: The trading period begins with an opening price. This is the price at which the asset starts trading.

- Price Ascension: The price then rises significantly during the trading period. Buyers attempt to push the price upwards, creating the long upper shadow.

- Rejection and Price Decline: Sellers then enter the market, overpowering the buyers. The price is pushed down from the high, eventually closing near the opening price.

- Closing Price: The closing price is at or very close to the opening price and the low of the period, forming the body of the Doji. The body is usually a thin line, indicating very little price movement between the open, close, and low.

- Long Upper Shadow: A long upper shadow is a key characteristic, demonstrating the rejection of higher prices. The length of the shadow indicates the extent of the price rejection.

This sequence paints a picture of a market where buyers initially show strength, but sellers ultimately regain control, leading to a bearish sentiment.

Trading Relevance

The Gravestone Doji holds significant trading relevance as it suggests a potential shift in market sentiment. Here's why:

- Bearish Reversal Signal: The pattern is primarily a bearish reversal signal. It often appears at the top of an uptrend, suggesting that the bullish momentum is weakening, and a potential downtrend may follow.

- Indecision and Rejection: The formation of a Gravestone Doji indicates indecision in the market. Buyers attempted to drive the price higher, but sellers rejected these higher prices. This rejection is often interpreted as a sign of waning buying pressure.

- Confirmation with Other Indicators: Traders often look for confirmation of the bearish signal with other technical indicators. For example, a break below the low of the Gravestone Doji can be a trigger for a short position. Also, the pattern is often validated by trading volume; higher volume during the formation of the Gravestone Doji strengthens the bearish signal.

- Entry and Exit Strategies: Traders can use the Gravestone Doji to form entry and exit strategies. For example, a short position could be initiated when the price breaks below the low of the Doji, with a stop-loss order placed above the high of the candlestick. Conversely, the pattern can be used to exit long positions. When the Gravestone Doji forms after a sustained uptrend, traders might consider exiting their long positions to avoid potential losses.

- Risk Management: Traders should incorporate risk management techniques. This includes using stop-loss orders to limit potential losses, and assessing the overall market context before making trading decisions.

Risks

While the Gravestone Doji is a useful pattern, it's essential to be aware of the associated risks:

- False Signals: The pattern can sometimes generate false signals. This can occur when the price reverses shortly after the formation of the Doji, leading to losses if a trader has entered a short position based on the pattern.

- Market Context: The effectiveness of the Gravestone Doji depends heavily on the market context. It's more reliable when it appears at the top of an uptrend. In a sideways market, the pattern may not provide reliable signals.

- Confirmation is Crucial: Relying solely on the Gravestone Doji for trading decisions is not advisable. Traders should use it in conjunction with other technical indicators and analysis tools to confirm the bearish signal.

- Volatility: During periods of high market volatility, the pattern might be less reliable, as price movements can be erratic and difficult to predict.

- Time Frame: The reliability of the Gravestone Doji can vary depending on the time frame. It's often more reliable on longer time frames (e.g., daily, weekly charts) compared to shorter time frames (e.g., hourly, minutes charts).

History/Examples

The Gravestone Doji is a widely recognized pattern used across various financial markets. Here are some examples and context:

- Stock Market: Imagine a stock trading steadily upwards. Then, during a trading session, the price surges significantly, but sellers step in, driving the price back down to the opening level. This forms a Gravestone Doji, signaling a potential reversal. If the next day's trading confirms this with a price decline, it validates the pattern.

- Cryptocurrency: In the volatile world of cryptocurrencies, the Gravestone Doji is frequently observed. Consider Bitcoin during a period of bullish momentum. If a Gravestone Doji appears, it might indicate that the rally is losing steam, and a correction could be on the horizon. Traders would then watch for further confirmation before taking action.

- Forex: In the foreign exchange market, the pattern can signal a potential reversal in currency pairs. For instance, if the EUR/USD pair is in an uptrend and a Gravestone Doji appears, it could suggest a weakening of the Euro against the US Dollar.

- Real-World Example: Consider a stock that has been steadily increasing in price for several weeks. Suddenly, the price opens, rises sharply, but then sellers take control, driving the price back down to the opening price. This forms a Gravestone Doji. The next day, if the price continues to decline, it confirms the bearish signal, and traders might consider shorting the stock, anticipating a further price decrease.

- Confirmation: Always remember to look for additional confirmation. This might be a break below the low of the Gravestone Doji, increased trading volume, or other technical indicators that support the bearish signal. For example, a MACD (Moving Average Convergence Divergence) crossover can act as a confirmation signal.

Understanding the Gravestone Doji can significantly improve your trading strategies. However, always remember to use it in conjunction with other analysis tools and to practice sound risk management techniques.

⚡Trading Benefits

20% CashbackLifetime cashback on all your trades.

- 20% fees back — on every trade

- Paid out directly by the exchange

- Set up in 2 minutes

Affiliate links · No extra cost to you

20%

Cashback

Example savings

$1,000 in fees

→ $200 back