Bump and Run Reversal: Decoding the Market's U-Turn

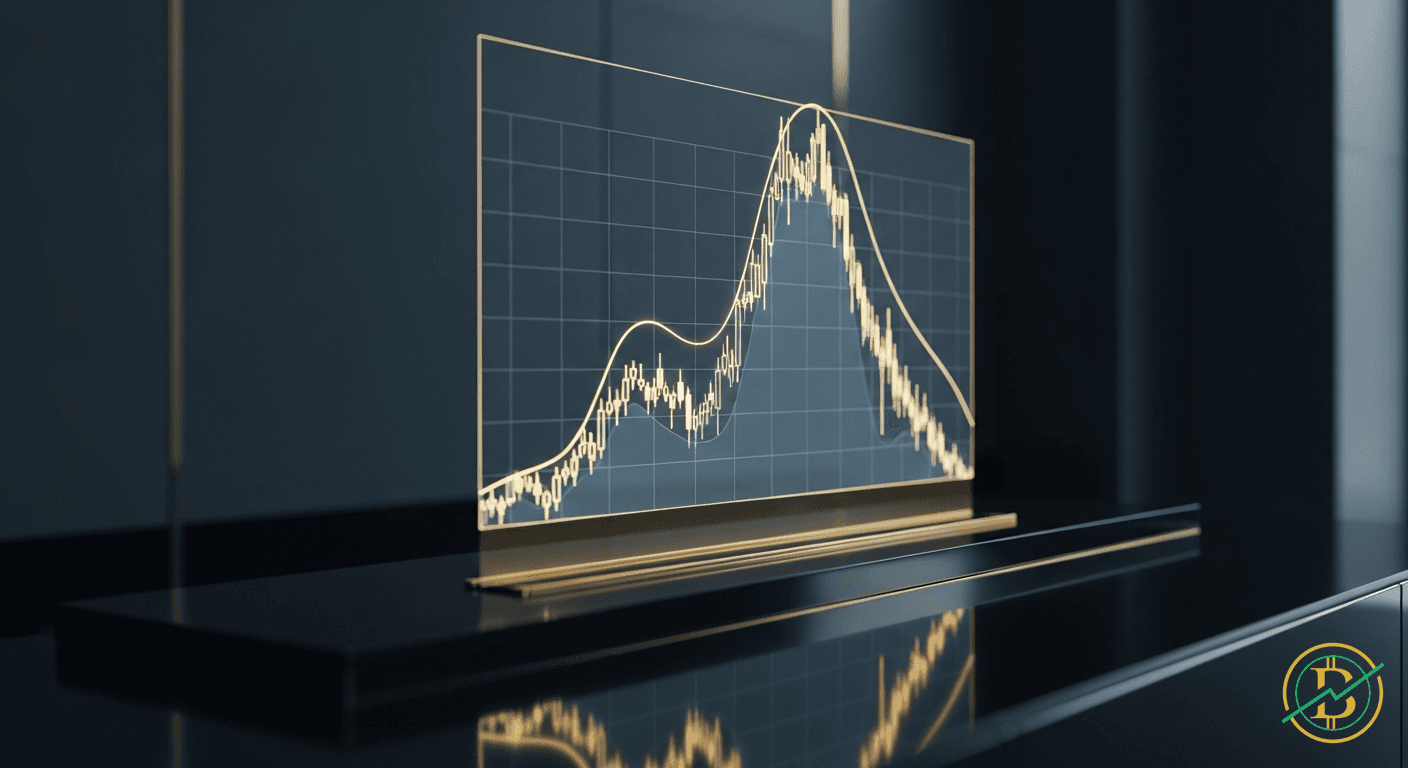

The Bump and Run Reversal (BARR) pattern signals a potential end to an uptrend, providing traders with an opportunity to anticipate a price decline. This pattern, characterized by a rapid 'bump' followed by a sustained 'run', offers valuable insights into market sentiment and potential profit-taking strategies.

Bump and Run Reversal: Decoding the Market's U-Turn

Definition: The Bump and Run Reversal (BARR) is a bearish chart pattern that suggests a trend reversal from an uptrend to a downtrend. Think of it like a car speeding up, hitting a bump, and then starting to slow down. It’s a visual representation of market sentiment shifting from bullish (optimistic) to bearish (pessimistic).

Key Takeaway: The Bump and Run Reversal pattern helps traders identify potential short-selling opportunities by recognizing the exhaustion of buying pressure after a rapid price increase.

Mechanics: Dissecting the BARR

The BARR pattern comprises three distinct phases: the lead-in, the bump, and the run. Understanding each phase is crucial for identifying and trading this pattern effectively.

-

Lead-in Phase: This is the initial, gradual uptrend. Price increases steadily, often with a defined channel or trendline. The lead-in phase reflects a period of consistent buying pressure and positive market sentiment. It's like the steady climb of a stock price during a period of good news and investor confidence.

-

Bump Phase: This is the dramatic, parabolic rise in price. It's often triggered by a surge of buying activity, fueled by hype, FOMO (Fear Of Missing Out), or excessive optimism. The bump phase is characterized by a rapid price increase, often exceeding the established trendline of the lead-in phase. This rapid increase is unsustainable and represents an overbought condition. This is the 'bump' – the price shoots up quickly, driven by unsustainable excitement.

-

Run Phase: After the bump, the price begins to decline. This is the reversal, the beginning of the downtrend. The price breaks the trendline and often retraces a significant portion of the bump. The run phase confirms the reversal and signals a shift in market sentiment. It's like the car starting to slow down after hitting the bump, eventually turning around.

Definition: A trendline is a line drawn on a price chart connecting a series of highs or lows. It helps to visualize the direction of the trend and identify potential support and resistance levels.

Trading Relevance: Capitalizing on the Reversal

The BARR pattern provides traders with a valuable opportunity to anticipate a price decline and potentially profit from short-selling or exiting long positions.

-

Identifying the Pattern: The first step is to recognize the three phases of the pattern. Look for a gradual lead-in, a sharp bump, and then signs of a price decline.

-

Entry Strategy: Traders often enter a short position (betting on a price decrease) when the price breaks below the trendline of the bump phase. Another entry point can be on a retest of the trendline, offering a lower-risk entry.

-

Stop-Loss Placement: A stop-loss order is placed above the high of the bump, to limit potential losses if the pattern fails and the price continues to rise. This is crucial risk management.

-

Targeting Profit: Traders use several methods to determine profit targets. One common method is to measure the height of the bump and project that distance downwards from the breakout point. Another is to identify key support levels.

-

Volume Analysis: Pay attention to volume. Volume should increase during the bump phase and then decrease during the run phase, confirming the pattern. High volume on the breakout of the trendline further confirms the pattern.

Risks: Navigating the Pitfalls

While the BARR pattern can be a profitable trading strategy, it's essential to be aware of the associated risks.

-

False Signals: Not all BARR patterns lead to a successful reversal. The pattern can fail, and the price can continue to rise. This is why stop-loss orders are so important.

-

Volatility: The bump phase can be highly volatile, leading to rapid price swings. This volatility can trigger stop-loss orders prematurely.

-

Market Manipulation: In some cases, market manipulation can create the appearance of a BARR pattern, trapping traders on the wrong side of the trade. Always use multiple sources and indicators.

-

Confirmation Bias: Be aware of confirmation bias – the tendency to interpret information in a way that confirms pre-existing beliefs. Don't force a pattern where it doesn't exist.

History/Examples: Real-World Applications

The BARR pattern has appeared across various markets, including stocks, forex, and cryptocurrencies. Here are some examples:

-

Early Bitcoin Mania (2013): During the initial surge of Bitcoin in 2013, several BARR patterns formed as the price experienced rapid gains followed by sharp corrections. Traders who identified these patterns could have profited from the subsequent price declines.

-

Altcoin Pumps and Dumps: Many altcoins experience BARR patterns during pump-and-dump schemes. The initial pump creates the bump, and the subsequent dump represents the run.

-

Stock Market Corrections: The BARR pattern can be observed in the stock market during periods of market correction. The initial uptrend is followed by a period of overvaluation (the bump), and then a decline as investors take profits and sentiment shifts.

-

Commodity Markets: Even in commodity markets, such as gold or oil, the BARR pattern can appear. News events or shifts in supply and demand can trigger the bump, followed by a correction.

Advanced Considerations:

-

Volume Confirmation: Always confirm the pattern with volume analysis. Decreasing volume during the run phase is a strong confirmation signal.

-

Fibonacci Retracement Levels: Use Fibonacci retracement levels to identify potential support and resistance levels during the run phase. These levels can help you determine profit targets and stop-loss placements.

-

Other Technical Indicators: Combine the BARR pattern with other technical indicators, such as the Relative Strength Index (RSI) or Moving Averages, to increase the probability of success.

-

Timeframe: The BARR pattern can appear on various timeframes, from intraday charts to weekly charts. The timeframe you choose will impact the risk and reward of the trade.

-

Market Context: Always consider the overall market context. The BARR pattern is more reliable in a bearish market or a market experiencing overbought conditions.

⚡Trading Benefits

20% CashbackLifetime cashback on all your trades.

- 20% fees back — on every trade

- Paid out directly by the exchange

- Set up in 2 minutes

Affiliate links · No extra cost to you

20%

Cashback

Example savings

$1,000 in fees

→ $200 back