Biturai Trading Wiki

The ultimate crypto encyclopedia. Verified by experts.

Exhaustion Gap: Identifying Trend Reversals in Crypto Trading

An Exhaustion Gap is a price gap that appears near the end of a strong trend, hinting at an impending reversal. Traders can use this pattern to anticipate shifts in market direction and adjust their strategies accordingly.

Runaway Gap: A Comprehensive Guide

A **Runaway Gap** is a candlestick pattern that appears on a price chart, signaling a continuation of an existing trend. This gap, distinct from a common gap or a breakaway gap, suggests strong market conviction and often leads to significant price movement in the direction of the trend.

Gap Trading in Crypto: A Comprehensive Guide

Gap trading in cryptocurrency involves identifying and capitalizing on price gaps, which are areas on a chart where no trading activity occurs. This guide delves into the mechanics of gaps, trading strategies, and the associated risks.

Falling Three Methods Candlestick Pattern: A Comprehensive Guide

The Falling Three Methods is a bearish continuation candlestick pattern, signaling that an existing downtrend will likely continue. This pattern provides valuable insights for traders seeking to identify potential selling opportunities and manage risk effectively.

Three Rising Methods: Decoding Bullish Momentum in Crypto

The Three Rising Methods is a bullish candlestick pattern that signals a continuation of an existing uptrend. This pattern suggests that buyers are in control, and the price is likely to continue rising.

Inverse Cup and Handle: A Bearish Crypto Pattern Explained

The Inverse Cup and Handle is a bearish chart pattern signaling potential price declines in the crypto market. It resembles an upside-down cup with a handle, indicating a possible trend reversal or continuation of a downtrend. Traders use this pattern to identify potential short selling opportunities.

Cup and Handle Chart Pattern: A Comprehensive Guide for Crypto Traders

The Cup and Handle pattern is a bullish continuation pattern that signals a potential breakout in a cryptocurrency's price. Understanding this pattern allows traders to identify opportunities for profit and manage risks effectively.

Rectangle Pattern: A Comprehensive Guide to Crypto Trading

The Rectangle Pattern is a powerful tool in technical analysis, signaling periods of consolidation before a potential breakout. Understanding this pattern allows traders to identify opportunities and manage risk effectively.

Symmetrical Triangle Chart Pattern: A Comprehensive Guide for Crypto Traders

The symmetrical triangle is a versatile chart pattern signaling a period of consolidation before a potential breakout or breakdown. This article provides a deep dive into its mechanics, trading strategies, and risk management, equipping crypto traders with the knowledge to identify and capitalize on these opportunities.

Descending Triangle Pattern: A Comprehensive Guide

The Descending Triangle is a bearish chart pattern signaling potential price drops, recognizable by a horizontal support and declining highs. Understanding this pattern is crucial for crypto traders aiming to anticipate and profit from market downturns.

Pennant Pattern Explained: A Comprehensive Guide for Crypto Traders

The Pennant pattern is a continuation pattern in technical analysis, signaling a brief pause in a price trend before the trend continues. Understanding this pattern can significantly improve your trading strategies in the volatile crypto markets.

Bear Flag: A Comprehensive Guide for Crypto Traders

The bear flag is a bearish continuation pattern, signaling a likely continuation of a downtrend. Understanding this pattern allows traders to anticipate potential price declines and manage risk effectively.

Flag Pattern in Crypto Trading: A Comprehensive Guide

The flag pattern is a popular chart formation used in technical analysis to identify potential continuation of an existing trend. This guide will teach you everything you need to know about identifying and trading flag patterns in the crypto market.

Island Reversal Pattern in Crypto Trading

The Island Reversal is a powerful chart pattern signaling a potential major shift in market direction. It's identified by a price gap, followed by a consolidation phase forming an 'island', and then another gap in the opposite direction.

Kicker Pattern: A Comprehensive Guide

The Kicker Pattern is a powerful two-candlestick formation signaling a sharp reversal in price direction. It indicates strong buying or selling pressure, often leading to significant price movements. Understanding this pattern can significantly improve your trading strategies.

Three Black Crows Candlestick Pattern: A Biturai Guide

The Three Black Crows is a bearish candlestick pattern indicating a potential trend reversal from bullish to bearish. It is formed by three consecutive long bearish candlesticks.

Tweezer Top Candlestick Pattern: A Comprehensive Guide

The Tweezer Top is a bearish reversal candlestick pattern that signals a potential shift from bullish to bearish momentum. Identifying this pattern can help traders anticipate price declines and make informed trading decisions.

Piercing Pattern Explained: A Comprehensive Guide

The Piercing Pattern is a bullish reversal candlestick formation signaling a potential shift from a downtrend to an uptrend. Understanding this pattern, its mechanics, and associated risks is crucial for making informed trading decisions.

Engulfing Pattern Explained: A Comprehensive Guide

The **Engulfing Pattern** is a powerful candlestick formation signaling potential market reversals. This pattern, easily recognizable, suggests a shift in momentum, offering traders valuable insights into price action and potential trading opportunities.

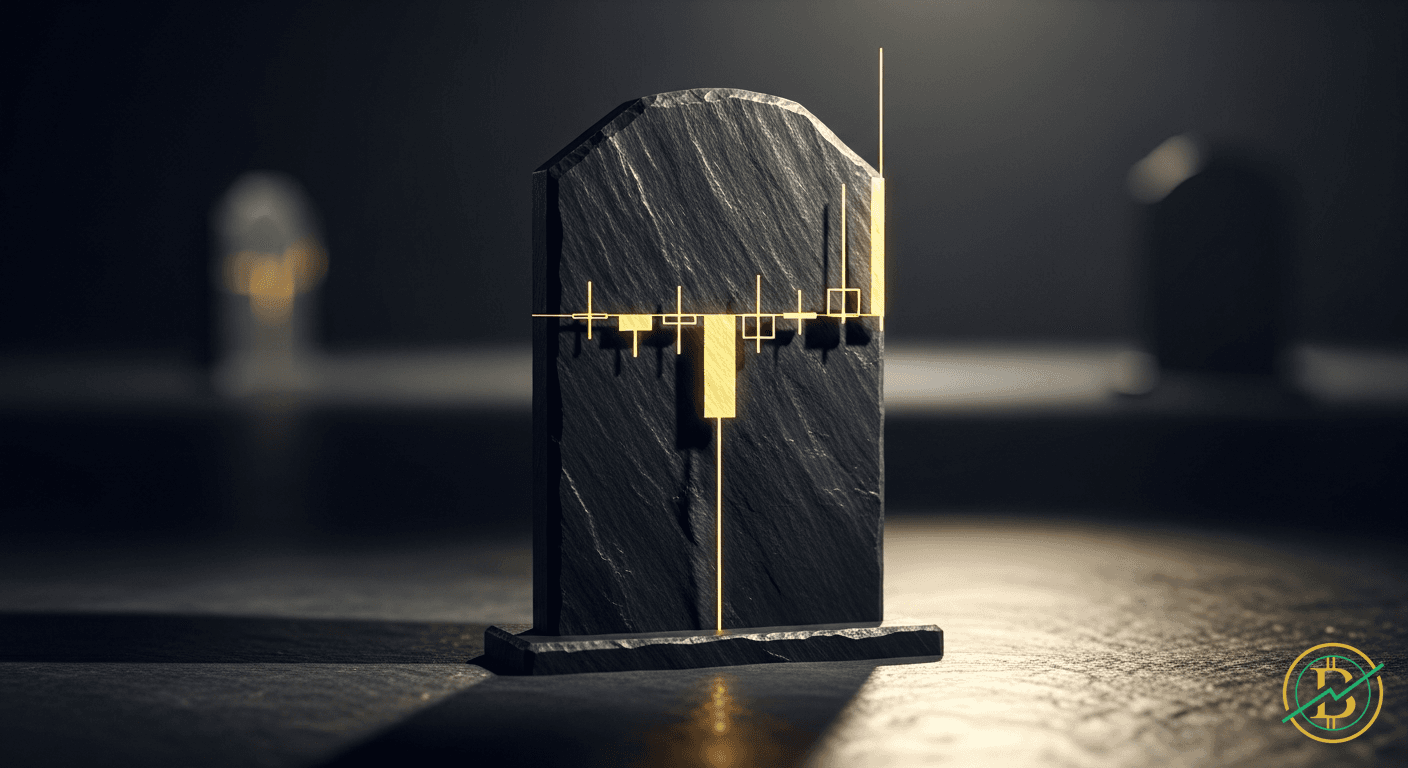

Gravestone Doji: A Comprehensive Guide to Bearish Reversal

The Gravestone Doji is a bearish candlestick pattern that signals a potential reversal of an uptrend. It forms when the opening, closing, and low prices of an asset are nearly the same, resembling an inverted 'T'.