Biturai Trading Wiki

The ultimate crypto encyclopedia. Verified by experts.

Changpeng Zhao (CZ): The Architect of Binance

Changpeng Zhao, known as CZ, is the visionary founder and former CEO of Binance, the world's largest cryptocurrency exchange. He is a key figure in the crypto industry, shaping its growth and accessibility for millions globally.

Charles Hoskinson: Architect of Cardano and Pioneer of Blockchain Innovation

Charles Hoskinson is a prominent figure in the cryptocurrency world, best known for co-founding Ethereum and founding Cardano. He is a mathematician and entrepreneur, deeply involved in blockchain technology and its potential for societal impact.

Nick Szabo: The Architect of Smart Contracts and Crypto Pioneer

Nick Szabo is a brilliant computer scientist and legal scholar who laid the groundwork for modern cryptocurrencies. He is best known for conceptualizing **smart contracts** and designing **Bit Gold**, a precursor to Bitcoin. His ideas revolutionized how we think about contracts and digital currency.

Trading Meditation: Mastering the Mind for Crypto Success

Trading meditation is the practice of using mindfulness techniques to improve your mental state and decision-making when trading cryptocurrencies. By cultivating focus, emotional control, and awareness, traders can reduce stress, avoid impulsive actions, and enhance their overall performance in the volatile crypto markets.

Moving Stop-Loss: A Comprehensive Guide

A moving stop-loss is a dynamic trading tool that adjusts your stop-loss order as the price of an asset moves in your favor. This allows you to protect profits and minimize potential losses, adapting to market volatility and trends.

Chasing the Market in Cryptocurrency Trading

Chasing the market in crypto means making impulsive trades based on recent price movements, often fueled by fear of missing out (FOMO) or greed. This behavior typically leads to losses because traders enter positions at unfavorable prices, buying high and selling low.

Analysis Paralysis in Crypto Trading

Analysis paralysis is a common problem in crypto trading, where traders become overwhelmed by information and struggle to make decisions. It leads to missed opportunities and can erode confidence. This article will break down what it is, how it affects you, and how to overcome it.

Hot Hand Fallacy in Crypto Trading: Avoiding the Winning Streak Trap

The Hot Hand Fallacy is a cognitive bias that makes traders believe a winning streak is a sign of skill, leading to poor decisions. This article explains what it is, how it affects trading, and how to avoid its pitfalls.

Endowment Effect in Crypto: Understanding Ownership Bias

The **Endowment Effect** is a cognitive bias where we value things we own more than identical things we don't. This can lead to poor trading decisions, as we become overly attached to our holdings.

Disposition Effect in Crypto: Understanding Investor Behavior

The disposition effect describes the tendency for investors to sell assets that have increased in value too early, while holding onto losing assets for too long. Understanding this cognitive bias is crucial for making informed investment decisions and avoiding common pitfalls in the crypto market.

Herding Behavior in Crypto Markets: A Biturai Guide

Herding behavior in crypto markets describes how investors often follow the actions of others, leading to amplified price movements. Understanding this phenomenon is crucial for navigating the volatile crypto landscape and making informed trading decisions.

Hindsight Bias in Crypto Trading: A Biturai Guide

Hindsight bias is the tendency to believe, after an event has occurred, that one would have predicted it. This bias can severely impact trading decisions, leading to overconfidence and poor risk management.

Loss Aversion in Crypto Trading: Understanding and Overcoming the Bias

Loss aversion is a common psychological bias where the pain of losing money feels stronger than the pleasure of gaining the same amount. This article explores loss aversion, its impact on crypto trading decisions, and strategies to mitigate its negative effects.

Bankroll Management in Crypto Trading: A Comprehensive Guide

Bankroll management is the cornerstone of successful crypto trading, protecting your capital and ensuring longevity in the market. This guide provides a detailed look at how to effectively manage your funds, minimizing risk and maximizing your chances of profit.

Implied Volatility in Crypto Options Explained

Implied Volatility (IV) is a crucial concept in crypto options trading, representing the market's expectation of future price fluctuations. Understanding IV helps traders assess risk and make informed decisions about option pricing and trading strategies.

Standard Deviation in Crypto Trading: A Biturai Guide

Standard deviation is a crucial statistical tool that measures the volatility of an asset's price. It helps traders understand the potential risk and variability in the market, allowing for more informed decision-making.

Elder Force Index: Decoding Market Momentum

The Elder Force Index (EFI) is a technical indicator that helps traders gauge the strength behind price movements by combining price changes and volume. It's like a speedometer for the market, revealing the energy driving buying and selling pressure.

Percentage Price Oscillator PPO

The Percentage Price Oscillator (PPO) is a momentum indicator used in technical analysis to gauge the trend and momentum of an asset's price. It helps traders identify potential buy and sell signals by comparing two moving averages.

Ultimate Oscillator: Mastering Momentum in Crypto Trading

The Ultimate Oscillator (UO) is a technical indicator designed to measure price momentum across multiple timeframes, helping traders identify potential trend reversals. It combines short, medium, and long-term price action to provide a more comprehensive view of market dynamics.

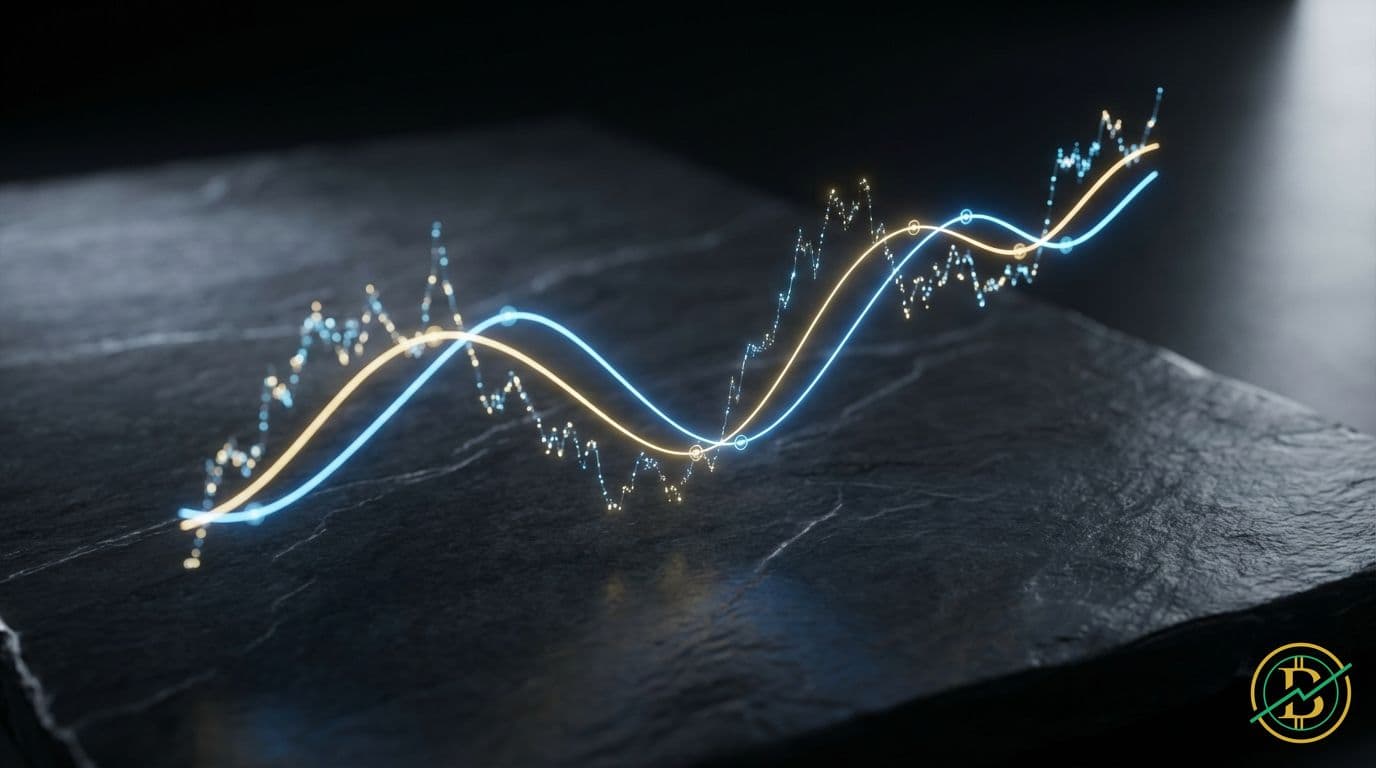

Double Exponential Moving Average (DEMA) Explained

The Double Exponential Moving Average (DEMA) is a technical indicator used to smooth price data and identify trends. It aims to reduce the lag inherent in traditional moving averages, providing quicker signals for traders.