Double Exponential Moving Average (DEMA) Explained

The Double Exponential Moving Average (DEMA) is a technical indicator used to smooth price data and identify trends. It aims to reduce the lag inherent in traditional moving averages, providing quicker signals for traders.

Double Exponential Moving Average (DEMA) Explained

Definition: The Double Exponential Moving Average (DEMA) is a technical analysis indicator that smooths price data and helps traders identify trends. Think of it as a refined version of a regular moving average, designed to react more quickly to price changes. It is used to identify potential entry and exit points in trading.

Key Takeaway: DEMA provides faster signals and reduces lag compared to traditional moving averages, making it useful for identifying trends and potential trading opportunities.

Mechanics: How DEMA Works

At its core, DEMA is a mathematical calculation that combines multiple exponential moving averages. The goal is to reduce the lag often associated with traditional moving averages. Here’s a breakdown of the process:

Exponential Moving Average (EMA): An EMA is a type of moving average that gives more weight to recent prices, making it more responsive to new information.

-

Calculate the EMA: First, you need to calculate a standard EMA. This is done using the following formula:

EMA = (Price * Smoothing Factor) + (EMA of Previous Period * (1 - Smoothing Factor))

Where the smoothing factor is typically calculated as 2 / (Period + 1). For example, a 20-period EMA would have a smoothing factor of 2 / 21 = 0.0952

-

Calculate the Double EMA (DEMA): Next, you calculate the DEMA using the following formula:

DEMA = 2 * EMA - EMA(EMA)

Where EMA(EMA) is the EMA of the EMA. This means you take the EMA calculated in step 1, and then calculate an EMA of that EMA.

-

Calculate the DEMA for each period. Repeat steps 1 and 2 for each period to create the DEMA line on your chart.

This might seem complex, but trading platforms like TradingView or MetaTrader 4 will automatically calculate the DEMA for you. The key is understanding what the formula is designed to achieve: reducing lag.

Trading Relevance: Using DEMA in Practice

Traders use DEMA to identify trends, potential support and resistance levels, and possible entry and exit points for trades. Here's how:

- Trend Identification:

- Uptrend: When the DEMA is sloping upwards, and the price is above the DEMA, it suggests an uptrend.

- Downtrend: When the DEMA is sloping downwards, and the price is below the DEMA, it suggests a downtrend.

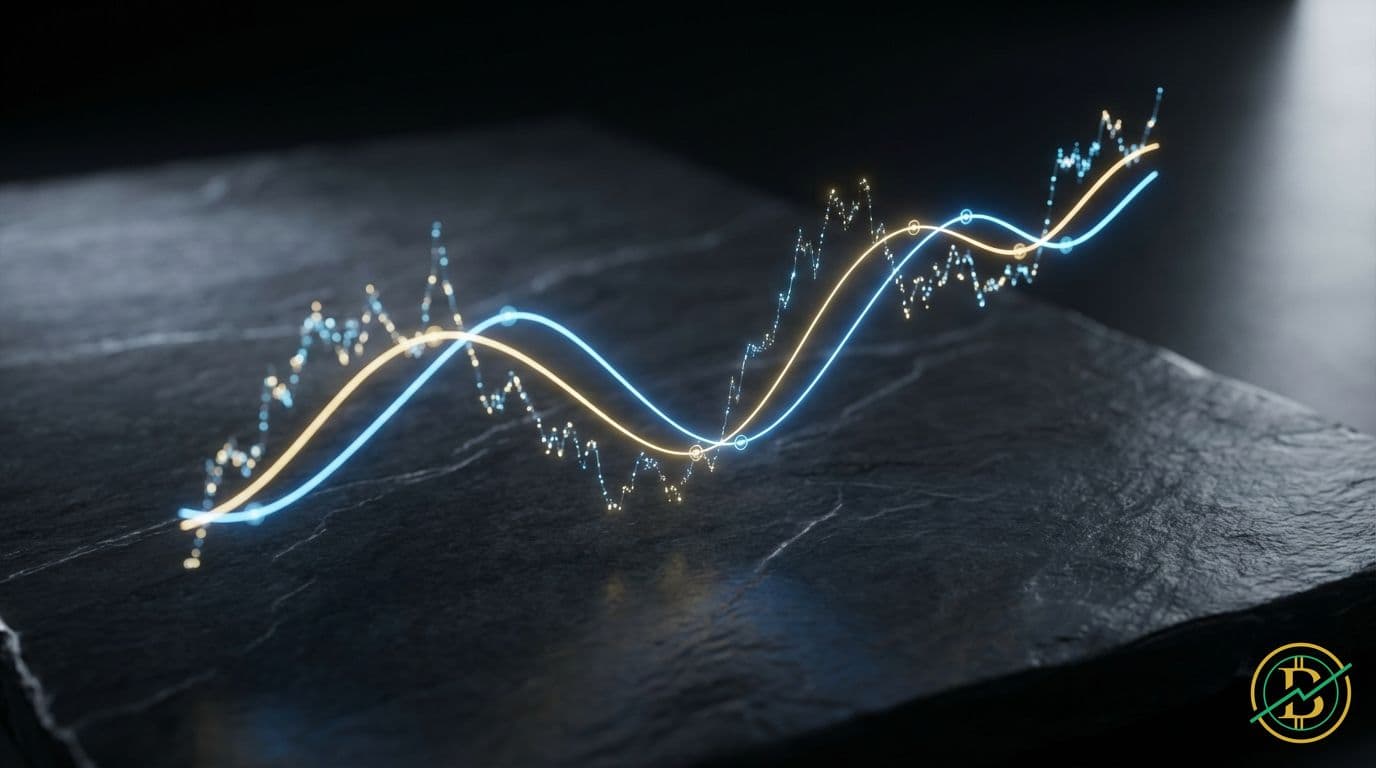

- Crossovers:

- Bullish Crossover: When a shorter-period DEMA (e.g., 20-period) crosses above a longer-period DEMA (e.g., 50-period), it can signal a potential buy signal.

- Bearish Crossover: When a shorter-period DEMA crosses below a longer-period DEMA, it can signal a potential sell signal (also known as a "death cross").

- Support and Resistance: The DEMA can act as dynamic support and resistance levels. The price may bounce off the DEMA line, providing potential entry or exit points.

Example: Imagine Bitcoin in 2021. During its bull run, the price frequently stayed above the 20-period DEMA, with dips often finding support at the DEMA line. A trader using DEMA could have used these signals to enter and exit trades.

Risks and Limitations

While DEMA offers advantages, it's essential to be aware of its limitations:

- False Signals: Like all technical indicators, DEMA can generate false signals, especially in choppy or sideways markets. The crossover signals might occur, but the price might not follow the anticipated trend.

- Lag Still Exists: Although DEMA reduces lag, it doesn't eliminate it entirely. Price movements will always precede the indicator's signals.

- Over-Optimization: Over-reliance on DEMA without considering other indicators or fundamental analysis can lead to poor trading decisions.

- Parameter Sensitivity: The performance of DEMA is sensitive to the chosen period lengths. Experimentation and backtesting are crucial to find the optimal settings for a specific asset and market conditions.

Important Warning: Never rely on a single indicator. DEMA should be used in conjunction with other tools and analysis methods, such as price action analysis, volume analysis, and fundamental research.

History and Examples

The DEMA was developed by Patrick Mulloy and introduced in the late 1990s. It's an improvement over traditional moving averages and the Exponential Moving Average (EMA). The goal was to create a moving average that responded more quickly to price changes.

Real-World Examples:

- Stock Trading: Traders use DEMA in the stock market to identify potential breakouts and trend reversals. For example, a DEMA crossover on a stock like Apple or Tesla could signal a buy or sell opportunity.

- Forex Trading: DEMA is also widely used in the Forex market. Traders may use DEMA to identify trends in currency pairs like EUR/USD or GBP/JPY.

- Crypto Trading: In the volatile crypto market, DEMA can be particularly useful for identifying short-term trends. A trader might use DEMA on Bitcoin or Ethereum charts to find entry and exit points. A 20/50 DEMA crossover can often serve as a signal to buy or sell.

In summary, the Double Exponential Moving Average is a valuable tool for traders seeking to identify trends and potential trading opportunities. However, like any technical indicator, it should be used with caution and in conjunction with other forms of analysis. Thorough testing and risk management are essential for successful trading.

⚡Trading Benefits

20% CashbackLifetime cashback on all your trades.

- 20% fees back — on every trade

- Paid out directly by the exchange

- Set up in 2 minutes

Affiliate links · No extra cost to you

20%

Cashback

Example savings

$1,000 in fees

→ $200 back