Biturai Trading Wiki

The ultimate crypto encyclopedia. Verified by experts.

Gann Square: Decoding Time and Price in Crypto

The Gann Square is a technical analysis tool that uses geometric principles to forecast price movements by analyzing time and price relationships. It helps traders identify potential support and resistance levels and predict future price targets.

Gann Fan: Decoding Price Action with Geometric Precision

The Gann Fan is a technical analysis tool that uses angles to predict future price movements. It helps traders identify potential support and resistance levels. Understanding the Gann Fan can significantly improve your ability to time trades and manage risk.

Fibonacci Time Zones: Decoding Market Timing

Fibonacci Time Zones are a technical analysis tool used to identify potential market turning points based on the Fibonacci sequence. They help traders anticipate when price reversals might occur. This article will explain how to use them effectively.

Fibonacci Arcs: A Biturai Trading Encyclopedia Deep Dive

Fibonacci Arcs are a technical analysis tool used by traders to identify potential support and resistance levels. They are based on the Fibonacci sequence and can help traders anticipate market reactions and plan trades strategically.

Fibonacci Fan: A Comprehensive Guide for Crypto Traders

The Fibonacci Fan is a technical analysis tool that helps traders identify potential support and resistance levels on a price chart. It uses Fibonacci ratios to project future price movements, aiding in informed trading decisions.

Fibonacci Extension: Projecting Price Targets in Crypto Trading

Fibonacci Extensions are a powerful technical analysis tool used by traders to forecast potential price targets after a trend has retraced. They utilize Fibonacci ratios to identify key levels where price may find support or resistance, helping traders plan entries and exits.

Money Flow in Crypto: A Comprehensive Guide

Money flow in crypto refers to the movement of capital into and out of the crypto market. Understanding money flow is crucial for traders as it directly impacts asset prices and market trends.

Ease of Movement Indicator: Decoding Price and Volume Dynamics

The Ease of Movement (EOM) indicator is a technical analysis tool that helps traders understand the relationship between price changes and trading volume. It essentially measures how easily a price moves up or down based on the volume supporting that movement.

Volume Profile: Your Guide to Market Depth

Volume Profile is a powerful technical analysis tool that reveals trading activity at specific price levels. By understanding where volume concentrates, traders can identify potential support and resistance zones, and make more informed decisions.

Chaikin Money Flow (CMF): A Comprehensive Guide

The Chaikin Money Flow (CMF) is a technical analysis indicator that measures the buying and selling pressure of an asset over a specific period. It helps traders identify potential trend reversals and assess the strength of a price movement by combining price and volume data.

Volatility Index (VIX) Explained for Crypto Traders

The Volatility Index (VIX), often called the "fear index", measures market expectations of future volatility. While a direct VIX equivalent doesn't exist for crypto, understanding its principles and applying them to crypto markets is crucial for risk management and informed trading.

Ulcer Index Explained for Crypto Traders

The Ulcer Index (UI) is a technical analysis tool that measures downside risk. It helps traders understand the potential for losses by quantifying the depth and duration of price drawdowns.

Chaikin Volatility: A Comprehensive Guide for Crypto Traders

Chaikin Volatility is a technical analysis tool that measures the fluctuation of an asset's price over a given period. It helps traders understand market risk and potential trading opportunities by highlighting periods of increasing or decreasing price swings.

Historical Volatility in Cryptocurrency

Historical volatility measures how much the price of a cryptocurrency has changed over a set period. Understanding historical volatility helps traders assess risk and make informed decisions about their investments.

Donchian Channels: A Comprehensive Guide for Crypto Traders

Donchian Channels are a technical analysis tool that helps traders identify price ranges and potential breakout opportunities. This guide provides a detailed explanation of how Donchian Channels work and how to use them effectively in cryptocurrency trading.

Bollinger Bandwidth: A Comprehensive Guide

Bollinger Bandwidth is a technical indicator that measures the distance between the upper and lower Bollinger Bands, offering insights into market volatility. It helps traders gauge potential price movements and identify periods of market expansion and contraction.

True Strength Index: Decoding Market Momentum

The True Strength Index (TSI) is a powerful technical indicator that helps traders understand market momentum and identify potential trend reversals. It's like a speedometer for the market, providing valuable insights into the strength and direction of price movements.

Accelerator Oscillator Explained: A Trader's Guide

The Accelerator Oscillator (AC) is a technical analysis tool that measures the acceleration or deceleration of market momentum. It helps traders anticipate potential trend reversals and identify the strength of the current price movement.

Awesome Oscillator: A Comprehensive Guide for Crypto Traders

The Awesome Oscillator (AO) is a momentum indicator used in crypto trading to gauge market momentum. It compares recent market movements to historic data, displayed in a histogram to predict momentum and trend reversals.

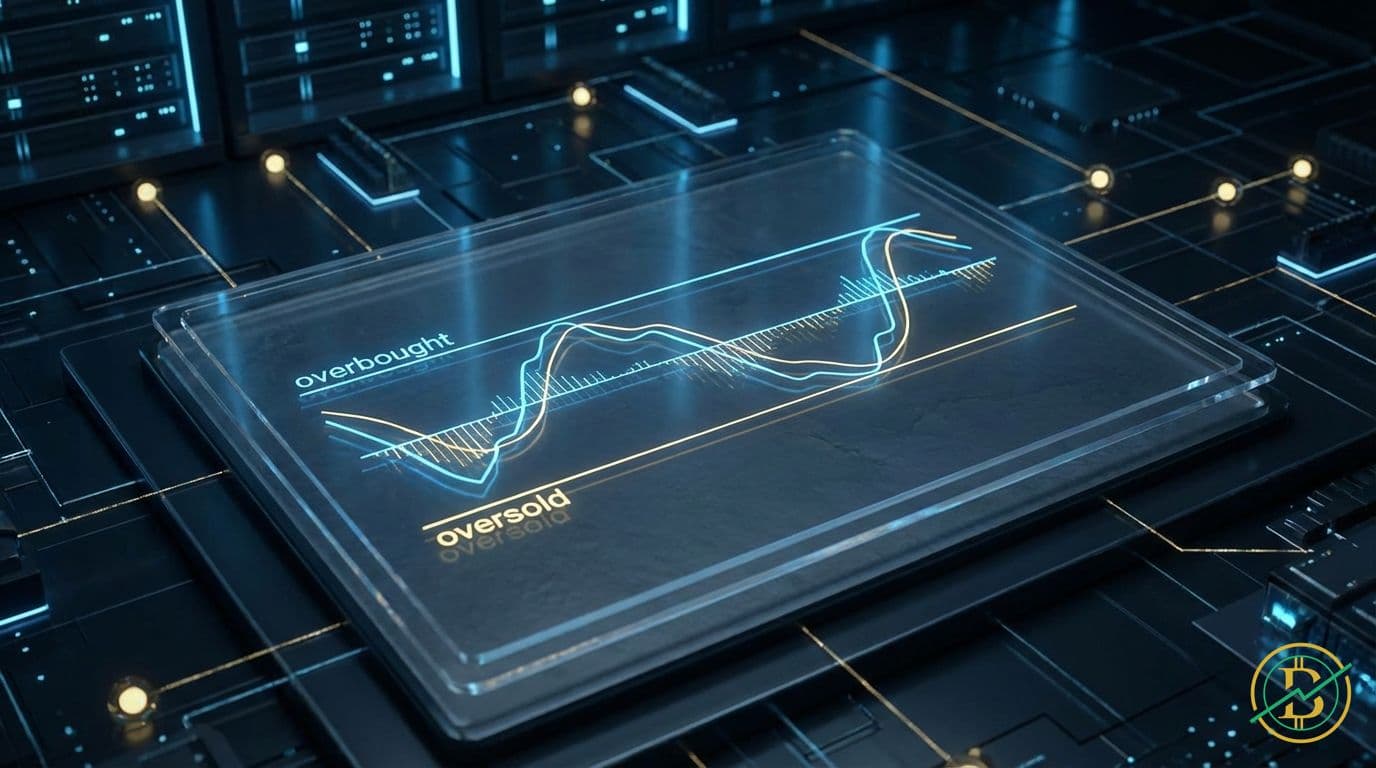

Commodity Channel Index (CCI): A Deep Dive for Crypto Traders

The Commodity Channel Index (CCI) is a versatile momentum oscillator that helps traders identify overbought and oversold conditions, potential trend reversals, and the strength of a trend. It measures the current price level relative to an average price level over a given period, offering valuable insights into market sentiment.