Biturai Trading Wiki

The ultimate crypto encyclopedia. Verified by experts.

Position Sizing: Mastering Risk and Reward in Crypto Trading

Position sizing is a crucial risk management technique in crypto trading. It involves determining the appropriate amount of capital to allocate to each trade, balancing potential profits with the acceptable level of risk.

Post-Only Order: A Deep Dive for Crypto Traders

A post-only order is a specific type of trading instruction designed to ensure your order only adds liquidity to the market. This means your order only becomes a 'maker' order and won't be immediately filled, helping you avoid taker fees and potentially improve your trading strategy.

Conditional Orders in Cryptocurrency Trading

Conditional orders are instructions to execute a trade only when specific criteria are met, typically a price level. They allow traders to automate their strategies and react to market movements without constant monitoring.

One Cancels the Other (OCO) Orders Explained

One-Cancels-the-Other (OCO) orders allow traders to set two orders simultaneously, with the execution of one automatically canceling the other. This strategy provides flexibility in managing risk and capitalizing on potential price movements.

Good Till Cancelled (GTC) Orders: A Deep Dive

A Good Till Cancelled (GTC) order is a type of trading order that stays active until it's either filled or you cancel it. This can be a useful tool for traders who want to automatically execute trades at a specific price, even when they're not actively watching the market.

Immediate or Cancel (IOC) Orders in Cryptocurrency Trading

An Immediate or Cancel (IOC) order is a type of trade instruction in cryptocurrency markets. It demands immediate execution of a buy or sell order, canceling any portion that cannot be filled instantly.

Fill or Kill Orders: A Comprehensive Guide

A Fill or Kill (FOK) order is a type of trading instruction. It demands that an order be executed immediately and entirely at the specified price, or it is canceled. These orders are used by traders who need immediate and guaranteed execution.

Trailing Take Profit Explained

A Trailing Take Profit (TTP) is an automated order that locks in profits as the price of an asset moves in your favor. It's a powerful tool for managing risk and maximizing potential gains in volatile markets. This article breaks down how TTPs work, their benefits, and how to use them effectively.

Take-Profit Order: Crypto Trading Strategy Explained

A Take-Profit (TP) order is a crucial tool in crypto trading, designed to automatically secure profits when a predetermined price target is reached. This article explains how TP orders work, their benefits, and important considerations for successful trading.

IDO Participation: A Comprehensive Guide

IDO participation allows early access to promising crypto projects by investing in their tokens before they hit public exchanges. Understanding the mechanics, risks, and trading implications of IDOs is crucial for navigating the decentralized finance (DeFi) landscape.

ICO Investing Explained: Your Guide to Initial Coin Offerings

An **Initial Coin Offering (ICO)** is a fundraising method used by cryptocurrency projects, similar to an IPO in traditional finance. ICOs offer early investors the chance to purchase new digital tokens, potentially at a low price, with the hope that the token's value will increase.

Diagonal Spreads: A Comprehensive Guide

A diagonal spread is an options strategy that combines buying and selling options contracts with different strike prices and expiration dates. This strategy allows traders to express a directional view on an underlying asset while managing cost and risk.

Bear Put Spread: A Comprehensive Guide

A bear put spread is a strategy used in options trading to profit when the price of an asset declines. It involves buying a put option with a higher strike price and selling a put option with a lower strike price, both expiring on the same date.

Bull Call Spread: A Comprehensive Guide

A Bull Call Spread is a bullish options strategy designed to profit from a moderate increase in an asset's price. It involves buying a call option and simultaneously selling another call option with a higher strike price, both with the same expiration date.

Iron Butterfly Options Strategy

The Iron Butterfly is a neutral options trading strategy designed to profit from a lack of significant price movement in an underlying asset. This strategy involves simultaneously buying and selling options to create a defined risk, defined reward trade.

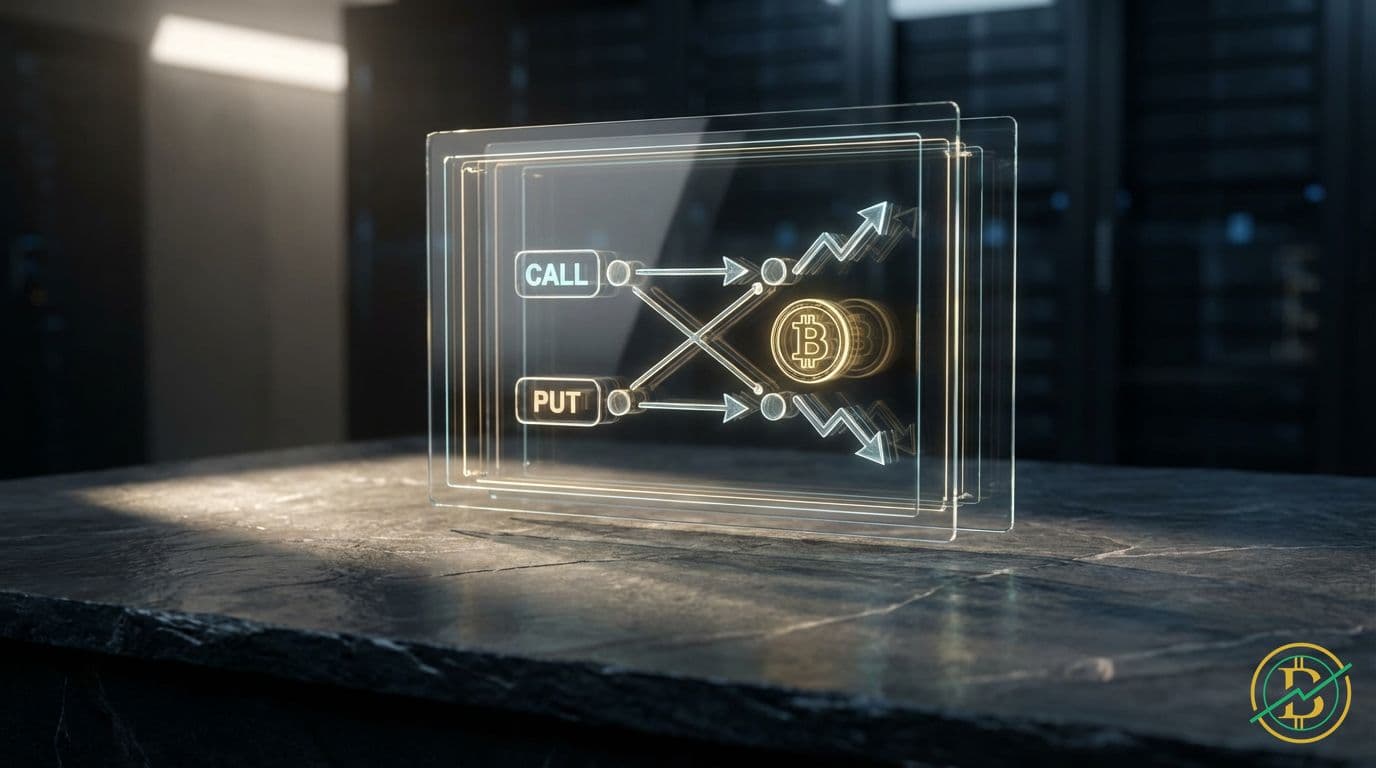

Strangle Options Strategy: A Comprehensive Guide

The Strangle options strategy involves simultaneously buying a call option and a put option on the same underlying asset, with the same expiration date but different strike prices. This strategy profits when the price of the underlying asset moves significantly in either direction.

Straddle: A Crypto Options Strategy Explained

A straddle is a sophisticated options strategy used to profit from significant price movements in either direction. It involves simultaneously buying a call and a put option with the same strike price and expiration date, allowing traders to profit from volatility.

Protective Put: Comprehensive Guide for Crypto Investors

A protective put is an options strategy designed to limit the potential downside risk of owning an asset. It involves buying a put option on an asset you already own, essentially creating a price floor for your investment.

Covered Call Strategies in Crypto

A covered call is an options trading strategy where you own an asset and sell call options on that same asset. This strategy aims to generate income from your holdings while potentially limiting your upside.

Crypto Options Trading: A Comprehensive Guide

Crypto options trading allows you to speculate on the future price of a cryptocurrency without having to buy or sell it directly. This guide explains how options work, the risks involved, and how to develop effective trading strategies.