Triangular Arbitrage in Cryptocurrency

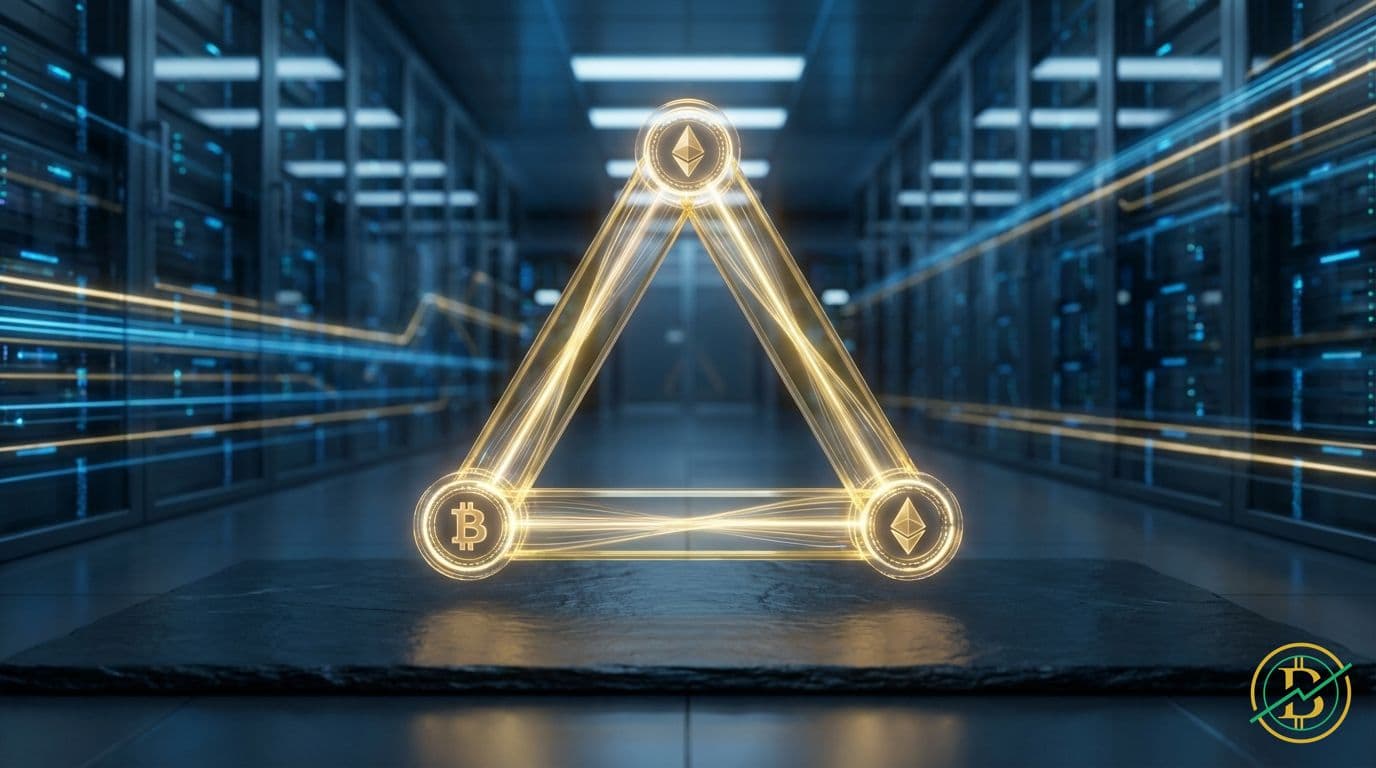

Triangular arbitrage is a trading strategy that exploits price differences between three cryptocurrencies. Traders can profit by executing a series of trades in a loop, capitalizing on these temporary market inefficiencies.

Triangular Arbitrage in Cryptocurrency

Definition: Triangular arbitrage is a trading strategy that exploits price discrepancies between three different cryptocurrencies, allowing traders to profit from market inefficiencies.

Key Takeaway: Triangular arbitrage capitalizes on temporary price imbalances in a cycle of three cryptocurrency trades to generate profit.

Mechanics

Imagine a currency exchange market, but instead of just exchanging USD for EUR, you're trading cryptocurrencies. Triangular arbitrage takes advantage of tiny price differences that can appear between three different cryptocurrencies when they are traded against each other. It's like finding a loophole in the pricing of three currencies, allowing you to profit by buying and selling them in a specific sequence.

The process works like this:

-

Identify the Opportunity: You need to find a situation where the exchange rates between three cryptocurrencies don’t align perfectly. For example, let's say:

- 1 Bitcoin (BTC) = 30,000 US Dollars (USD)

- 1 Ethereum (ETH) = 1,500 USD

- 1 BTC = 20 ETH

- These prices create a market inefficiency because trading in a circle (BTC -> ETH -> USD -> BTC) yields a profit.

-

Calculate the Profitability: Before you start trading, you need to calculate whether the price differences will allow you to make a profit after considering trading fees. You must ensure that the profit margin is larger than the fees for the trade, or else you will lose money.

-

Execute the Trades: This is the critical step. You need to execute three trades in a sequence, usually on the same exchange, as quickly as possible. The order of trades is crucial. In our example, if we start with 1 BTC:

- Trade 1: Buy ETH with BTC (e.g., trade 1 BTC for 20 ETH).

- Trade 2: Buy USD with ETH (e.g., trade 20 ETH for 30,000 USD).

- Trade 3: Buy BTC with USD (e.g., trade 30,000 USD for 1.001 BTC).

-

Closing the Loop: After executing the trades, traders complete the crypto triangular arbitrage cycle by converting the final cryptocurrency back to the initial one.

Trading Relevance

Triangular arbitrage opportunities arise because of market inefficiencies. These inefficiencies can be caused by:

- Different Trading Volumes: The amount of trading activity for a specific pair can influence prices. Low trading volume can lead to wider spreads and opportunities.

- Different Exchanges: Prices can vary slightly across different cryptocurrency exchanges. This is due to several factors, including the number of traders on that exchange and the fees charged for trading.

- News and Events: Major news announcements or market events can cause rapid price fluctuations, potentially creating arbitrage opportunities.

- Algorithmic Trading: Many arbitrage opportunities are found and executed by algorithmic trading bots. These bots are programmed to identify and capitalize on price discrepancies very quickly.

Understanding these dynamics is key to identifying and profiting from triangular arbitrage.

Risks

Triangular arbitrage is not risk-free. Here are some critical risks to consider:

- Transaction Fees: Every trade incurs transaction fees. If the profit margin is too small, these fees can wipe out your gains or lead to a loss.

- Slippage: This happens when the price changes between the time you initiate the trade and when it is executed. Slippage can reduce your profit or even turn a profitable trade into a loss. This is why quick execution is crucial.

- Market Volatility: The cryptocurrency market is highly volatile. Prices can change rapidly, and a profitable arbitrage opportunity can disappear before you can execute all the trades.

- Exchange Risks: There's always the risk that the exchange could experience technical issues, delays, or even go offline during your trades, preventing you from completing the arbitrage cycle.

- Liquidity Risk: You may not be able to trade the required amounts of each cryptocurrency quickly enough, especially with less liquid pairs, to take advantage of the opportunity.

History/Examples

Triangular arbitrage isn't a new concept; it exists in all financial markets. It's simply the application of a basic arbitrage concept to three different assets instead of two. The first instance of arbitrage can be traced back to the 18th century, where traders would exploit the price differences of commodities across different markets.

In the cryptocurrency space, it has become a common trading strategy, especially with the growth of decentralized exchanges (DEXs) and the increasing number of trading pairs. While precise data on successful arbitrage trades is difficult to obtain, the strategy is widely used by both individual traders and automated trading bots. The emergence of DEXs has made it easier for people to perform the trades, and with the increase of new tokens, the opportunities have grown.

Consider the early days of Bitcoin (like Bitcoin in 2009). When the market was less mature, price differences between exchanges were often significant, creating many arbitrage opportunities. As the market has matured, these opportunities have become smaller and more fleeting, requiring faster execution and more sophisticated tools.

⚡Trading Benefits

Trade faster. Save fees. Unlock bonuses — via our partner links.

- 20% cashback on trading fees (refunded via the exchange)

- Futures & Perps with strong liquidity

- Start in 2 minutes

Note: Affiliate links. You support Biturai at no extra cost.