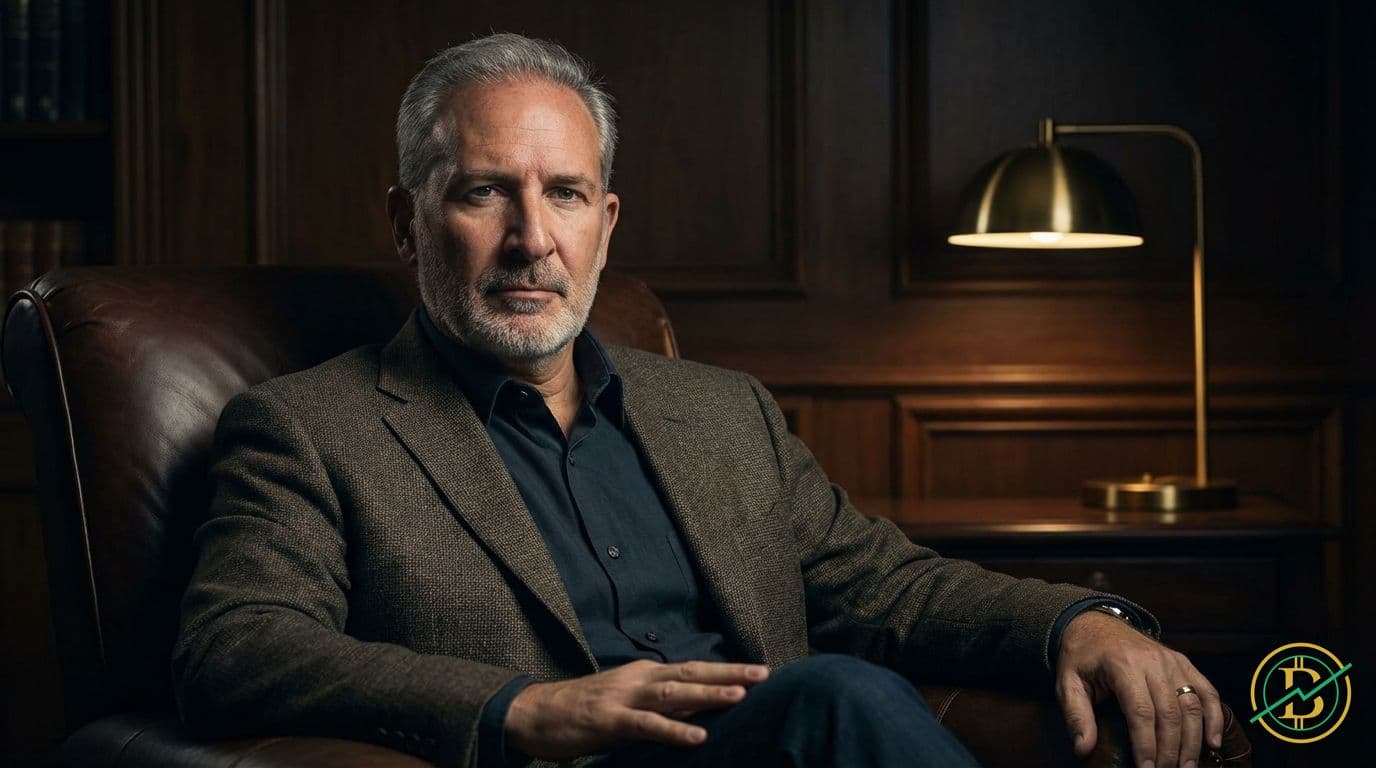

Peter Schiff Bitcoin Skepticism Explained

Peter Schiff is a prominent economist known for his skepticism towards Bitcoin and cryptocurrencies. Schiff believes Bitcoin's value is based on speculation rather than intrinsic value, and he often compares it unfavorably to traditional assets like gold.

Peter Schiff: A Bitcoin Skeptic's Perspective

Definition: Peter Schiff is a well-known economist and financial commentator who is a vocal critic of Bitcoin and other cryptocurrencies. He often advocates for traditional investments like gold and believes in the importance of sound money principles.

Key Takeaway: Peter Schiff's skepticism towards Bitcoin stems from his belief that it lacks intrinsic value, is based on speculation, and is not a reliable store of value or medium of exchange.

Mechanics: Schiff's Critique

Schiff's criticisms of Bitcoin are multifaceted. He often highlights several key points:

-

Lack of Intrinsic Value: Schiff argues that Bitcoin has no inherent value, unlike gold, which has industrial applications and a history as a store of value. He believes Bitcoin's value is derived solely from the willingness of others to buy it, making it vulnerable to price crashes.

-

Speculative Bubble: Schiff views Bitcoin as a speculative bubble, fueled by hype and FOMO (Fear Of Missing Out). He believes the price is driven by speculation rather than fundamental economic principles.

-

Volatility and Risk: He emphasizes Bitcoin's extreme price volatility, making it a risky investment. He contrasts this with the perceived stability of traditional assets, such as precious metals.

-

Limited Use Cases: Schiff questions the practical applications of Bitcoin. He argues that it is not widely accepted as a medium of exchange and faces challenges with scalability and transaction costs. He often compares it to gold in the context of it being a store of value, and not necessarily a currency used for day-to-day transactions.

-

Correlation Concerns: Schiff has noted that the price of Bitcoin has at times shown correlation with the tech stocks and other risk-on assets. He believes that this shows that Bitcoin is not a hedge against inflation.

-

Comparison to Gold: A central tenet of Schiff's investment philosophy is the value of gold as a safe-haven asset. He frequently compares Bitcoin unfavorably to gold, emphasizing gold's long history as a store of value and its tangible nature. He believes that gold has a proven track record as a hedge against inflation and economic uncertainty.

Trading Relevance: Understanding Schiff's View

Understanding Peter Schiff's perspective is valuable for traders, even if they disagree with his views. His arguments highlight key risks associated with Bitcoin and offer an alternative perspective on market dynamics.

- Risk Management: Schiff's warnings about volatility and speculation underscore the importance of risk management strategies, such as setting stop-loss orders and diversifying portfolios.

- Market Sentiment: His commentary can influence market sentiment, particularly among traditional investors. Traders should monitor his public statements and how they impact market perceptions.

- Alternative Investments: Schiff's advocacy for gold and other traditional assets provides a contrasting view to the cryptocurrency market. Traders can use his perspective to analyze potential investment opportunities in assets that Schiff favors.

- Long-Term Perspective: Schiff's long-term view of Bitcoin can challenge the prevailing narratives and encourage traders to think critically about the underlying fundamentals of the asset.

Risks: Potential Pitfalls

Schiff's analysis of Bitcoin highlights several critical risks that traders should be aware of:

- Volatility: Bitcoin's price is subject to significant fluctuations, making it a risky investment for those with a low-risk tolerance.

- Speculation: The market is driven by speculation, which can lead to rapid price swings and make it difficult to predict future price movements.

- Regulatory Risk: The regulatory landscape for cryptocurrencies is constantly evolving, and new regulations could negatively impact Bitcoin's price.

- Technological Risks: Bitcoin's technology is not without its risks. The blockchain could be hacked, or other technological failures could impact Bitcoin's viability.

- Counterparty Risk: Exchanges and custodians that hold Bitcoin can fail, leading to a loss of the Bitcoin held.

History/Examples: Schiff in Action

Peter Schiff's commentary on Bitcoin has been consistent over the years. Some notable examples include:

- Early Criticism: Schiff began criticizing Bitcoin early in its history, when its price was significantly lower. He warned of the risks associated with the asset.

- Debates and Discussions: He has participated in numerous debates and discussions about Bitcoin, often clashing with proponents of the cryptocurrency.

- Social Media Commentary: Schiff actively uses social media to share his views on Bitcoin, often commenting on price movements and market events.

- Tokenized Gold: Ironically, Schiff launched a tokenized gold product, demonstrating an understanding of blockchain technology’s potential for tokenizing assets, even while remaining skeptical of Bitcoin. This highlights the nuanced nature of his skepticism. He admitted that blockchain technology makes gold superior for trading purposes.

Peter Schiff's skepticism towards Bitcoin provides a valuable counterpoint to the prevailing narratives in the cryptocurrency market. While his views are often critical, they encourage traders to critically examine the risks and potential downsides of Bitcoin. By understanding his perspective, traders can make more informed investment decisions and develop more comprehensive risk management strategies.

⚡Trading Benefits

20% CashbackLifetime cashback on all your trades.

- 20% fees back — on every trade

- Paid out directly by the exchange

- Set up in 2 minutes

Affiliate links · No extra cost to you

20%

Cashback

Example savings

$1,000 in fees

→ $200 back