Crypto Options Trading: A Comprehensive Guide

Crypto options trading allows you to speculate on the future price of a cryptocurrency without having to buy or sell it directly. This guide explains how options work, the risks involved, and how to develop effective trading strategies.

Crypto Options Trading: A Comprehensive Guide

Definition: Options trading in the crypto world is like having a special ticket that gives you the option to buy or sell a cryptocurrency at a specific price on a specific date. You don't have to do it, but you can if it's beneficial. It's a derivative, meaning its value comes from an underlying asset, in this case, a cryptocurrency like Bitcoin or Ethereum.

Key Takeaway: Crypto options trading gives you the right, but not the obligation, to buy or sell a cryptocurrency at a predetermined price on a specific date, allowing you to speculate on price movements and manage risk.

Mechanics of Crypto Options

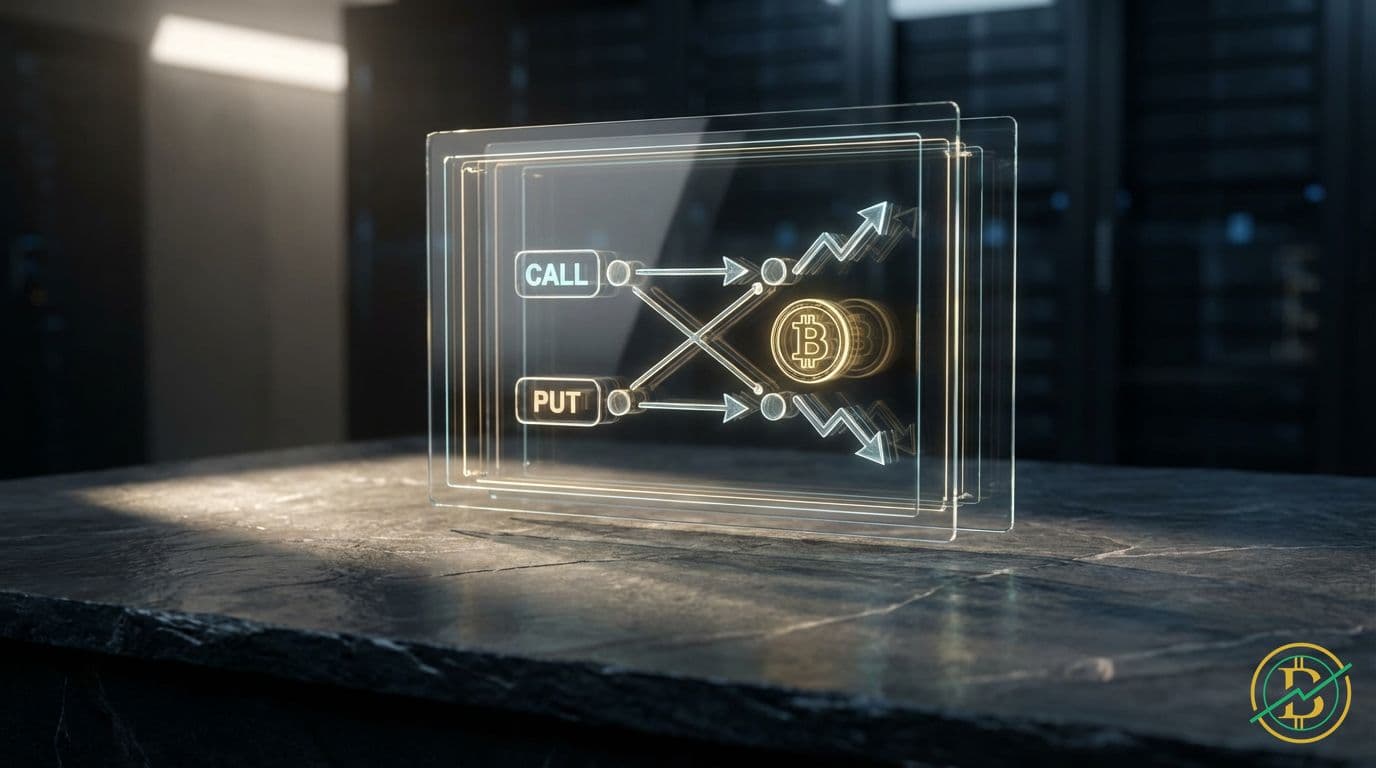

An option is a contract that gives the buyer the right, but not the obligation, to buy (call option) or sell (put option) an underlying asset at a predetermined price (strike price) on or before a specific date (expiration date).

Options contracts are based on a few key concepts:

- Underlying Asset: The cryptocurrency the option is based on (e.g., Bitcoin, Ethereum).

- Call Option: Gives the holder the right to buy the underlying asset at the strike price. You'd use a call option if you expect the price of the cryptocurrency to increase.

- Put Option: Gives the holder the right to sell the underlying asset at the strike price. You'd use a put option if you expect the price of the cryptocurrency to decrease.

- Strike Price: The price at which the underlying asset can be bought or sold if the option is exercised.

- Expiration Date: The date the option contract expires. After this date, the option is no longer valid.

- Premium: The price you pay to buy an option contract. This is the maximum amount you can lose.

How it Works: A Simple Example

Let's say Bitcoin is trading at $30,000. You believe the price will go up. You buy a call option with a strike price of $32,000 and an expiration date in one month, paying a premium of $1,000 (representing the cost of the option).

- Scenario 1: Bitcoin price goes to $35,000 before expiration: You exercise your call option, buying Bitcoin at $32,000. You then sell it at the market price ($35,000), making a profit of $3,000 (excluding trading fees).

- Scenario 2: Bitcoin price stays below $32,000 before expiration: You choose not to exercise your option. You lose the premium of $1,000, but no further losses are incurred.

Put Option Example

Let's say Bitcoin is trading at $30,000 and you believe the price will fall. You buy a put option with a strike price of $28,000 and an expiration date in one month, paying a premium of $500.

- Scenario 1: Bitcoin price falls to $25,000 before expiration: You exercise your put option, selling Bitcoin at $28,000. You would have bought the Bitcoin at $25,000, making a profit of $3,000 (excluding trading fees).

- Scenario 2: Bitcoin price stays above $28,000 before expiration: You choose not to exercise your option. You lose the premium of $500.

Trading Relevance: Strategies and Price Drivers

Crypto options trading offers a wide range of strategies based on market outlook and risk tolerance. Understanding the factors that drive price movements is crucial for effective trading.

Common Trading Strategies:

- Buying Calls: Used when you are bullish (expecting the price to go up). You profit if the price of the underlying asset rises above the strike price plus the premium paid.

- Buying Puts: Used when you are bearish (expecting the price to go down). You profit if the price of the underlying asset falls below the strike price minus the premium paid.

- Selling Covered Calls: Used by holders of the underlying asset. You sell a call option on your holdings, collecting a premium. If the price rises above the strike price, you must sell your assets at that price. This limits your upside potential but generates income.

- Selling Naked Puts: Selling a put option without owning the underlying asset. You profit if the price stays above the strike price. If the price falls below the strike price, you are obligated to buy the asset at that price.

- Straddles and Strangles: Complex strategies involving buying or selling both call and put options with the same or different strike prices and expiration dates. Used to profit from high volatility, even without predicting the direction of the price.

Price Drivers:

- Market Sentiment: Overall investor mood. Positive sentiment often drives prices up, and negative sentiment leads to price drops.

- Supply and Demand: The basic economic principle. High demand and low supply increase prices. The opposite decreases prices. For crypto, this is influenced by factors like new adoption, institutional investment, and regulatory news.

- News and Events: Major announcements (e.g., regulatory decisions, technological updates, partnerships) can significantly impact prices.

- Technical Analysis: Traders use charts and indicators to identify trends and predict future price movements. Options traders often use technical analysis to determine strike prices and expiration dates.

- Volatility: Options prices are directly affected by volatility. Higher volatility generally means higher option prices, as there's a greater chance of large price swings.

Risks of Crypto Options Trading

Crypto options trading is inherently risky. The high volatility of the crypto market can lead to significant losses if not managed carefully.

- High Volatility: The rapid price swings of cryptocurrencies can quickly make options contracts worthless or cause substantial losses.

- Time Decay (Theta): Options lose value as they approach their expiration date. This is known as time decay. Traders need to account for this erosion of value.

- Leverage: Options trading allows for leverage, amplifying both potential profits and losses. A small movement in the underlying asset's price can result in significant financial consequences.

- Complex Strategies: Many options strategies are complex and require a deep understanding of market dynamics and risk management. Mistakes can be costly.

- Liquidity Risk: Some options contracts, particularly for less popular cryptocurrencies, may have low liquidity. This makes it difficult to buy or sell options at the desired price and can lead to slippage (the difference between the expected price of a trade and the price at which the trade is executed).

- Counterparty Risk: In some options markets, you are exposed to the risk of the counterparty defaulting on their obligations.

Risk Management:

- Proper Research: Conduct thorough research on the underlying asset and the options contracts.

- Set Stop-Loss Orders: Limit potential losses by setting stop-loss orders.

- Manage Position Size: Don't risk more than you can afford to lose. Start with small positions.

- Diversify: Don't put all your capital into a single options trade. Diversify across different assets and strategies.

- Understand Greeks: Learn about the Greeks (Delta, Gamma, Theta, Vega, Rho) which measure the sensitivity of an option's price to various factors (e.g., price changes, time decay, volatility changes).

- Use a Demo Account: Practice your trading strategies on a demo account before risking real money.

History and Examples

Options trading has a long history, but its application in the crypto space is relatively new and rapidly evolving.

- Early Days: Crypto options trading emerged as a way for institutional investors and sophisticated traders to hedge their positions and speculate on price movements in the early days of Bitcoin (like a call option on Bitcoin in 2009). Early platforms were limited and offered fewer options.

- Growth and Development: As the crypto market grew, so did the demand for options trading. Major exchanges like Deribit, OKX, and Binance began offering options trading platforms, providing more liquidity and a wider range of options contracts.

- Institutional Adoption: Institutional investors, such as hedge funds and family offices, have started using crypto options to manage risk and generate returns. This has further increased the trading volume and sophistication of the market.

- Examples of Successful Options Trades:

- Hedging against a price drop: An investor holding a large amount of Bitcoin buys put options to protect against a potential price decline. If the price falls, the put options provide a hedge, offsetting the losses on their Bitcoin holdings.

- Speculating on a price increase: A trader buys call options on Ethereum, expecting the price to rise. If the price increases significantly before the expiration date, the trader can profit from the options contract.

- Generating income: A Bitcoin holder sells covered calls, collecting premiums. As long as the price stays below the strike price, they keep the premium.

Conclusion

Crypto options trading is a powerful tool for those seeking to speculate on price movements, manage risk, and generate income in the volatile crypto market. However, it's essential to understand the mechanics, strategies, and risks involved. Thorough research, proper risk management, and a disciplined approach are crucial for success in crypto options trading. Learning the basics of options trading is a fundamental step in becoming a more sophisticated crypto trader.

⚡Trading Benefits

20% CashbackLifetime cashback on all your trades.

- 20% fees back — on every trade

- Paid out directly by the exchange

- Set up in 2 minutes

Affiliate links · No extra cost to you

20%

Cashback

Example savings

$1,000 in fees

→ $200 back