Candlestick Body: The Core of Crypto Price Action

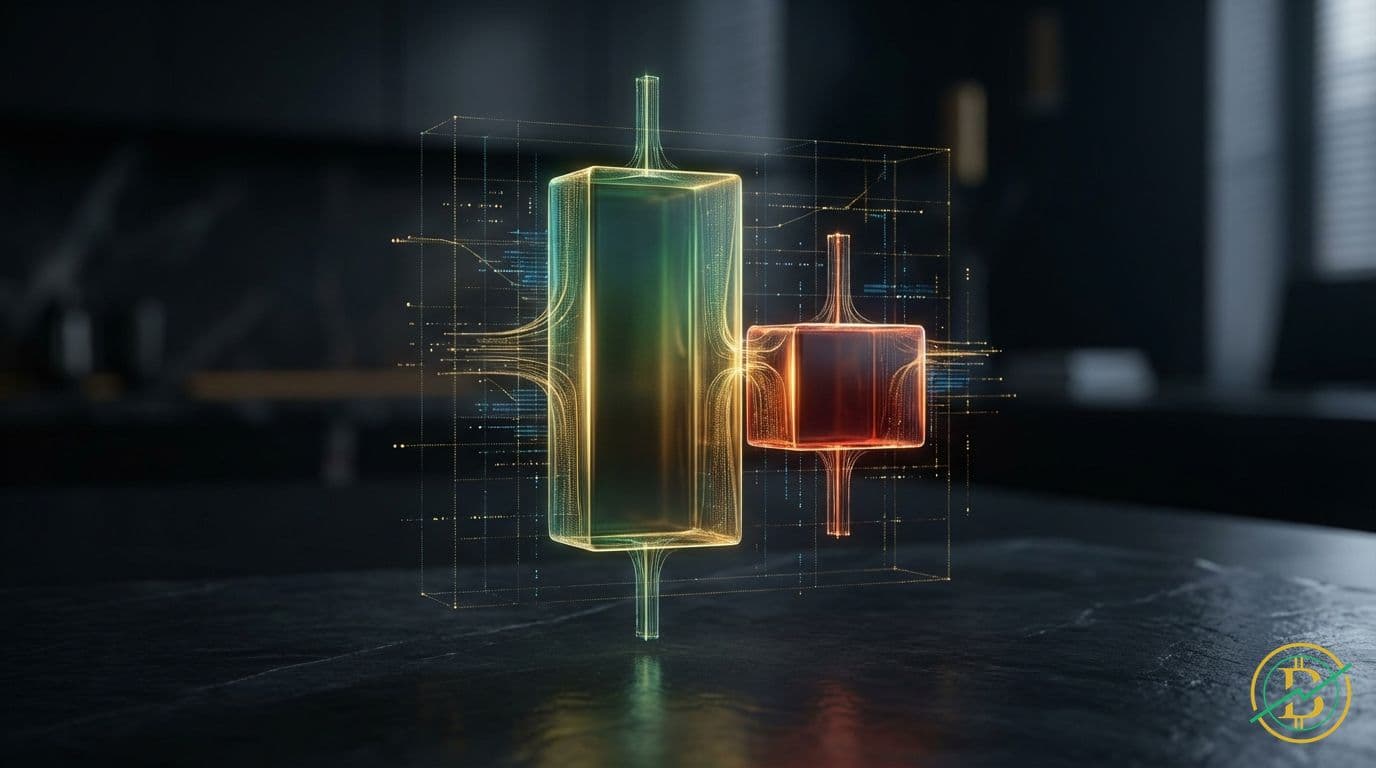

The **body** of a candlestick chart reveals the open and close prices of an asset over a specific period. Analyzing the body’s size, color, and relationship to the wicks helps traders understand market sentiment and predict future price movements.

Candlestick Body: The Core of Crypto Price Action

Definition

Imagine you're watching a game, and you want to know who won and by how much. A candlestick chart is like a scoreboard for the crypto market. It visually represents the price movements of an asset over a specific period, such as an hour, a day, or a week. The body of the candlestick is the main, rectangular part. It shows the difference between the opening price and the closing price during that time. The color of the body (green or red) tells you whether the price went up (bullish) or down (bearish).

Key Takeaway

The candlestick body is the primary indicator of price direction and the strength of buying or selling pressure within a given timeframe.

Mechanics

Let's break down how the body works. Each candlestick has a body and often has wicks (also called shadows) extending above and below it. The body is the most important part because it tells us the relationship between the opening and closing prices. Here's how it works:

-

Bullish Candlestick (Green/White): If the closing price is higher than the opening price, the body is typically filled in with green (or white in some charts). The bottom of the body represents the opening price, and the top represents the closing price. This indicates that buyers were in control during that period, and the price increased.

-

Bearish Candlestick (Red/Black): If the closing price is lower than the opening price, the body is typically filled in with red (or black). The top of the body represents the opening price, and the bottom represents the closing price. This signifies that sellers were in control, and the price decreased.

The size of the body is also crucial. A long body (either green or red) suggests strong buying or selling pressure. A short body suggests indecision or a balance between buyers and sellers. The wicks of the candlestick show the highest and lowest prices reached during the period. The body, therefore, tells the story of the price action between the open and close, while the wicks show the extremes.

Definition: The body of a candlestick represents the price range between the open and close for a given period. It's color indicates whether the price increased (bullish - green) or decreased (bearish - red).

Trading Relevance

Understanding the candlestick body is fundamental to technical analysis. It helps traders identify potential trends, reversals, and areas of support and resistance. Here's how:

- Body Size: A large green body after a downtrend can signal a potential bullish reversal, suggesting that buyers are stepping in. Conversely, a large red body after an uptrend might indicate a bearish reversal, with sellers taking control.

- Body Color: The color immediately tells you the direction of price movement. Consecutive green bodies indicate an uptrend, while consecutive red bodies suggest a downtrend.

- Body and Wicks Relationship: Combining the body with the wicks offers deeper insights. For example, a long lower wick with a small green body might indicate that buyers pushed the price up after a period of selling. A long upper wick with a small red body could suggest that sellers pushed the price down after a period of buying.

- Candlestick Patterns: The body plays a vital role in identifying candlestick patterns. Patterns such as Engulfing, Hammer, Shooting Star, and Doji rely on the body's size, color, and position to provide trading signals.

Risks

While the candlestick body is a powerful tool, it's not a crystal ball. Always consider the following risks:

- False Signals: Candlestick patterns can sometimes generate false signals, especially in volatile markets. Always confirm signals with other technical indicators or fundamental analysis.

- Timeframe Dependence: The interpretation of a body changes depending on the timeframe (e.g., 1-minute, daily, weekly). A strong signal on a short timeframe may not hold true on a longer one.

- Market Manipulation: In smaller or less liquid markets, price movements can be manipulated, leading to misleading candlestick formations.

- Emotional Trading: Don't let the visual representation of the body drive you to make impulsive decisions. Always have a trading plan and stick to it.

History/Examples

Candlestick charts originated in 18th-century Japan. Rice traders used them to analyze price movements, allowing them to predict market sentiment and make informed trading decisions. They were then adopted by Western traders in the late 20th century.

- Example 1: Bitcoin in 2021: During Bitcoin's bull run in 2021, you'd see numerous long green bodies appearing, indicating strong buying pressure and upward price movement. Conversely, periods of correction showed long red bodies, reflecting selling pressure.

- Example 2: Doji Formation: A Doji candlestick has a very small body, indicating indecision. It can signal a potential reversal. If a Doji appears after a long uptrend, it might suggest that the buying pressure is weakening, and a downtrend might be coming.

- Example 3: Engulfing Pattern: An Engulfing pattern involves a candlestick body that completely engulfs the previous one. A bullish engulfing pattern (green engulfing red) can signal a trend reversal to the upside. A bearish engulfing pattern (red engulfing green) can signal a trend reversal to the downside.

By understanding the candlestick body and its implications, you'll gain a significant advantage in the crypto market. Remember to combine this knowledge with other analysis tools and always manage your risk. Biturai's focus is on providing you with the tools and education you need to navigate the crypto world successfully.

⚡Trading Benefits

20% CashbackLifetime cashback on all your trades.

- 20% fees back — on every trade

- Paid out directly by the exchange

- Set up in 2 minutes

Affiliate links · No extra cost to you

20%

Cashback

Example savings

$1,000 in fees

→ $200 back