US Treasury Considers Bitcoin Reserve Leveraging Gold Holdings

Key Insights

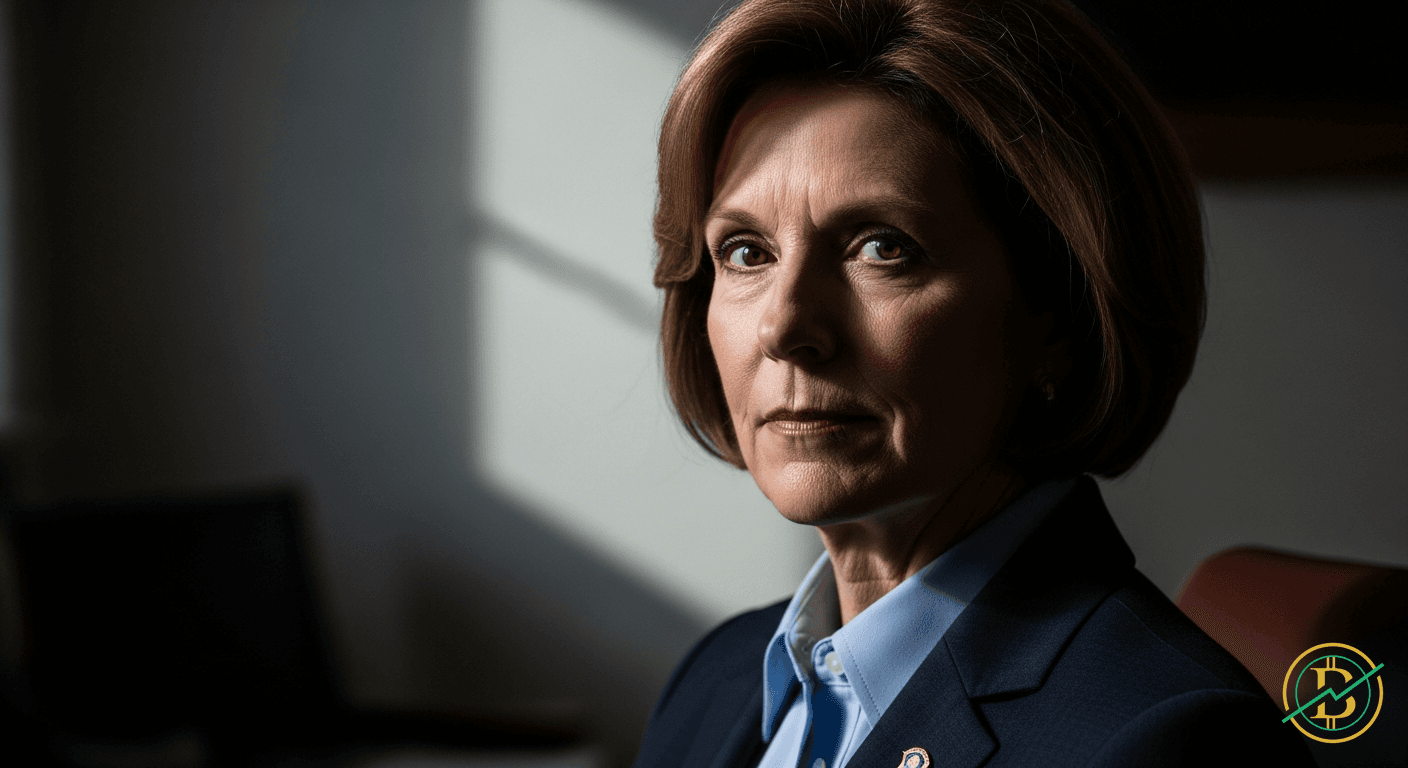

- →Senator Lummis advocates for using gold reserves to acquire Bitcoin.

- →The US government currently possesses significant Bitcoin holdings from seizures.

- →Institutional interest in Bitcoin remains robust despite recent price volatility.

What Happened?

Senator Cynthia Lummis has proposed a bold strategy for the US Treasury: utilizing the nation’s extensive gold reserves to establish a strategic Bitcoin (BTC) reserve. The proposal suggests a phased approach, potentially spanning five years, with the Treasury actively purchasing Bitcoin. This marks a notable shift in the ongoing debate surrounding digital assets and their potential integration into national financial strategies. The US government already has a considerable Bitcoin portfolio, primarily accumulated through seizures related to illicit activities. Officials are now considering the long term implications of direct Bitcoin purchases, evaluating its potential as a strategic asset.

This proposal arrives amidst a dynamic market environment where institutional investors are actively exploring and integrating Bitcoin into their portfolios. The Senator’s suggestion underscores a growing recognition of Bitcoin's evolving role within the broader financial landscape. The US government's current position presents both opportunities and challenges, requiring careful consideration of market dynamics, regulatory frameworks, and geopolitical implications. The debate is now centered on how the US should approach Bitcoin.

Background

The US government's interest in digital assets is not new. The legal and regulatory landscape surrounding cryptocurrencies has been under constant scrutiny. The accumulation of Bitcoin through seizures has highlighted the need for clarity and consistent policy. The fact that the US government already has a significant amount of Bitcoin from seizures has brought the discussion to the forefront. This background provides a crucial context for Senator Lummis’s suggestion.

Historically, gold has served as a cornerstone of the global financial system. The idea of leveraging gold reserves to acquire Bitcoin represents a potential diversification strategy. It would signal a change in how the US views the long term value of Bitcoin, moving beyond its function as a tool for illegal transactions.

Market Impact

The news has sparked conversations in the crypto community and within financial institutions. While Bitcoin has experienced significant price volatility recently, the proposal suggests a long term commitment from the government. Institutional demand for Bitcoin remains a key factor, with firms continuing to explore Bitcoin as part of their investment strategies. This demand provides support for Bitcoin even after price corrections. The possibility of the US government becoming a major Bitcoin holder has the potential to influence market sentiment.

⚡Trading Benefits

20% CashbackLifetime cashback on all your trades.

- 20% fees back — on every trade

- Paid out directly by the exchange

- Set up in 2 minutes

Affiliate links · No extra cost to you

20%

Cashback

Example savings

$1,000 in fees

→ $200 back

Related Articles

Disclaimer

This article is for informational purposes only. The content does not constitute financial advice, investment recommendation, or solicitation to buy or sell securities or cryptocurrencies. Biturai assumes no liability for the accuracy, completeness, or timeliness of the information. Investment decisions should always be made based on your own research and considering your personal financial situation.