Crypto Market Capitulation Intensifies as Outflows Accelerate

Key Insights

- →Significant capital flight from crypto markets mirroring conditions seen during the last bear cycle.

- →Realized value changes signal a pronounced shift towards capital liquidation across assets.

- →The trend potentially reflects broader macroeconomic anxieties influencing investor sentiment.

What Happened?

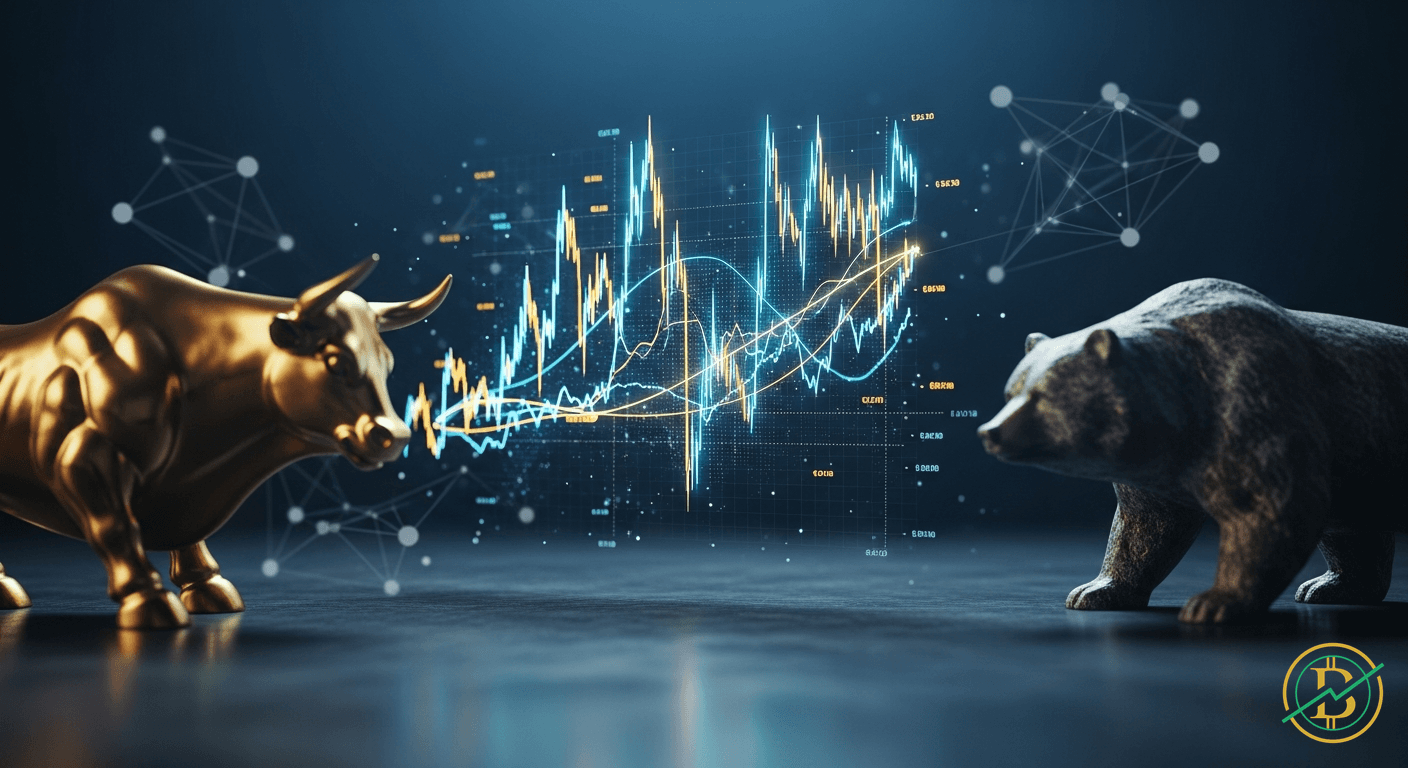

Recent onchain analysis reveals a dramatic acceleration in capital outflows from the cryptocurrency market. Data from leading onchain analytics provider Glassnode indicates that the "Aggregate Market Realized Value Net Position Change" metric has plunged into deeply negative territory. This suggests a significant and rapid liquidation of crypto assets. The current pace of capital exiting the market is reminiscent of the intense selling pressure observed during the trough of the previous bear market cycle. This widespread move away from crypto is impacting multiple asset classes, including established cryptocurrencies like Bitcoin (BTC) and Ethereum (ETH). This swift shift underscores a heightened level of investor caution and a possible increase in overall market risk aversion.

The sudden and concentrated nature of these outflows is a notable development. The data implies that a significant portion of the crypto market is currently undergoing a substantial sell off. This accelerated liquidation is particularly concerning for traders as it could create a cascading effect if further selling pressure continues to build. The implications of this trend are far reaching, affecting not only the price performance of major cryptocurrencies but also the overall stability and health of the digital asset ecosystem. The observed shift suggests a prevailing sentiment that could persist for some time.

Background

The "Aggregate Market Realized Value Net Position Change" metric, as analyzed by Glassnode, provides a view of capital flows across the crypto market by measuring the net change in realized value. It considers the difference between the average price at which coins were last moved onchain and their current market value. A negative value, as is currently being observed, signifies that the average selling price is lower than the average purchase price, indicating a net outflow of capital. This outflow is often triggered by a combination of factors, including macroeconomic conditions, regulatory uncertainties, and shifts in investor risk appetite.

During previous market downturns, this metric has served as a critical indicator of capitulation, where investors, often overwhelmed by fear, rush to liquidate their holdings. The historical context shows that periods of negative net position change have frequently preceded prolonged bear markets. The intensity of the current outflow, therefore, is a serious concern for experienced traders. Understanding this metric's significance and its historical relationship with market cycles is vital for navigating the current landscape.

Market Impact

The accelerating outflows are likely to exert continued downward pressure on crypto prices. Increased selling activity often leads to decreased liquidity, exacerbating price volatility and potentially triggering further liquidations. The market is currently in a vulnerable position. The magnitude and speed of these outflows suggest that the correction could extend further. This scenario would impact valuations across the board, affecting both well established projects and newer tokens.

Experienced traders should monitor key support levels and watch for signs of a potential bottoming out of the market. The behavior of large institutional investors and the actions of stablecoin issuers will also prove crucial. Furthermore, the actions of key market participants, including cryptocurrency CEOs and institutional investors, will be closely watched. Determining the duration and depth of this latest downturn hinges on investor sentiment, macroeconomic factors, and regulatory developments.

⚡Trading Benefits

20% CashbackLifetime cashback on all your trades.

- 20% fees back — on every trade

- Paid out directly by the exchange

- Set up in 2 minutes

Affiliate links · No extra cost to you

20%

Cashback

Example savings

$1,000 in fees

→ $200 back

Related Articles

Riot Blockchain Stock Surges on Shareholder Pressure for AI and High Performance Computing Expansion

Ethereum Inflows Spike as Whale Activity Signals Potential Shift

Institutional Shift Harvard Adjusts Crypto Exposure Favoring Ether

Crypto Funds Embrace Market Neutrality Amidst Heightened Volatility

Disclaimer

This article is for informational purposes only. The content does not constitute financial advice, investment recommendation, or solicitation to buy or sell securities or cryptocurrencies. Biturai assumes no liability for the accuracy, completeness, or timeliness of the information. Investment decisions should always be made based on your own research and considering your personal financial situation.