Bitcoin Price Consolidates Anticipating Significant Volatility

Key Insights

- →Bitcoin is currently forming a contracting price pattern.

- →Increased volatility is expected in the near future.

- →Traders should be prepared for substantial price movement.

What Happened?

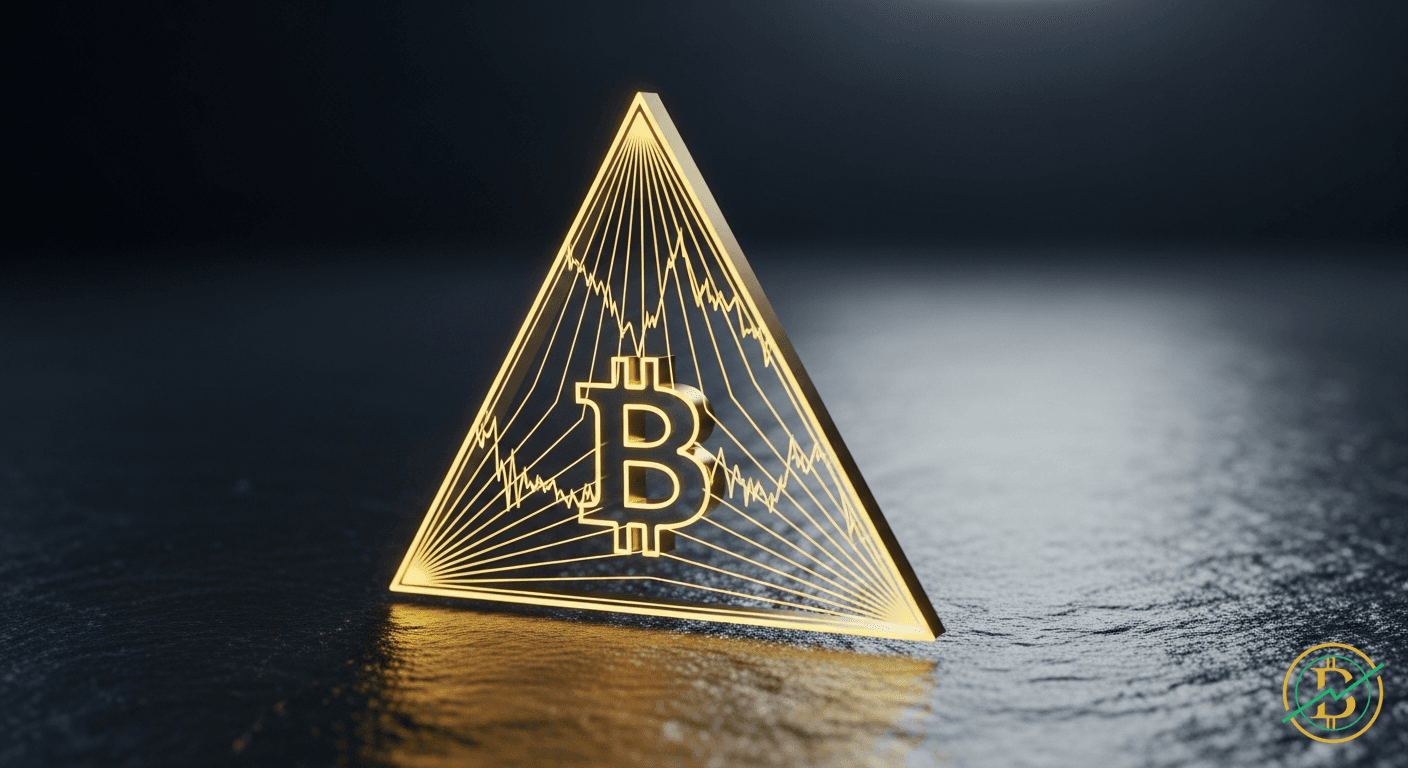

Bitcoin (BTC) is exhibiting a classic technical pattern: a symmetrical triangle formation. This pattern, characterized by converging trendlines, indicates a period of consolidation where both buying and selling pressure are gradually squeezing the price action. The apex of this triangle, the point where the support and resistance lines meet, represents a critical juncture. As the price compresses further, the range for trading narrows, ultimately leading to a breakout, a decisive move either above the resistance or below the support. This impending breakout is what experienced traders are closely watching, as it signals the potential for a significant price swing and increased market participation. The current structure suggests that a period of heightened volatility is imminent.

The tightening range experienced recently is a clear indicator of indecision within the market. Both bulls and bears are vying for control, leading to a stalemate that resolves itself through a breakout. The duration of this consolidation phase can vary, but the longer the pattern persists, the more powerful the subsequent move often becomes. Volume analysis during this period is also critical. A decrease in volume throughout the pattern, followed by a significant increase during the breakout, typically confirms the validity of the move. Traders and analysts are employing various tools, including moving averages, the Comparative Price Index (CPX), and other technical indicators, to define potential entry and exit points.

Background

The formation of a triangle pattern in Bitcoin’s price action is a recurring phenomenon observed throughout its history. These patterns frequently appear after substantial price movements, representing a breather or a pause before the next directional push. The origins of technical analysis, and the understanding of chart patterns like triangles, have been around for a long time. The pattern itself is considered a continuation pattern, meaning it often suggests a continuation of the prior trend, whether bullish or bearish. However, the breakout direction is not always predetermined.

The significance of these patterns is amplified by the sheer market capitalization of Bitcoin. Any substantial price movement in BTC has a ripple effect throughout the entire cryptocurrency market, impacting altcoins and investor sentiment broadly. The ability to identify these patterns early allows traders to strategically position themselves, either to profit from the breakout or to mitigate risk by adjusting positions. Monitoring onchain data, including Mean Transaction Time (MMT) and sentiment analysis (SENT) can provide additional context, and help traders better understand the broader market dynamics and potential catalyst for a move.

Market Impact

The expected breakout from the current triangle formation has the potential to trigger substantial market movement. If the breakout is to the upside, it could ignite a wave of buying, drawing in new participants and potentially driving the price to higher levels. Conversely, a breakdown below the support could lead to significant selling pressure, potentially initiating a downtrend. The increased volatility associated with the breakout will create opportunities for both profit and loss.

Experienced traders will be closely monitoring volume, order book depth, and other market indicators to confirm the breakout and gauge the strength of the move. Those who understand these patterns and effectively manage their risk, will be best positioned to capitalize on the ensuing volatility. The price action of BTC serves as a bellwether for the broader crypto market. Traders must be prepared for the impact of this move on their portfolios and trading strategies.

⚡Trading Benefits

20% CashbackLifetime cashback on all your trades.

- 20% fees back — on every trade

- Paid out directly by the exchange

- Set up in 2 minutes

Affiliate links · No extra cost to you

20%

Cashback

Example savings

$1,000 in fees

→ $200 back

Related Articles

Disclaimer

This article is for informational purposes only. The content does not constitute financial advice, investment recommendation, or solicitation to buy or sell securities or cryptocurrencies. Biturai assumes no liability for the accuracy, completeness, or timeliness of the information. Investment decisions should always be made based on your own research and considering your personal financial situation.